5 Best Nasdaq ETFs To Invest In

- Invesco (QQQ)

- Invesco Nasdaq 100 ETF (QQQM)

- Fidelity Nasdaq Composite Index ETF (ONEQ)

- Direxion Nasdaq-100 Equal Weighted Index Shares (QQQE)

- Invesco Nasdaq Next Gen 100 ETF (QQQJ)

The Nasdaq-100 is frequently confused with the Nasdaq Composite Index. The latter index (often referred to simply as "The Nasdaq") includes the stock of every company that is listed on Nasdaq (more than 3,000 altogether). The Nasdaq-100 is a modified capitalization-weighted index.There are multiple ways (such as ETFs, mutual funds, options, futures and annuities) that are accessible for investors at all levels to invest in Nasdaq-100®.

What drives the price of Nasdaq-100 : The weight given to each company included in the Nasdaq100 influences how the individual share price moves the overall index. The index is a weighted collective of share prices; in general, rising share prices will increase the value of the index and falling share prices will reduce it.

Should I invest in Nasdaq 100 in 2024

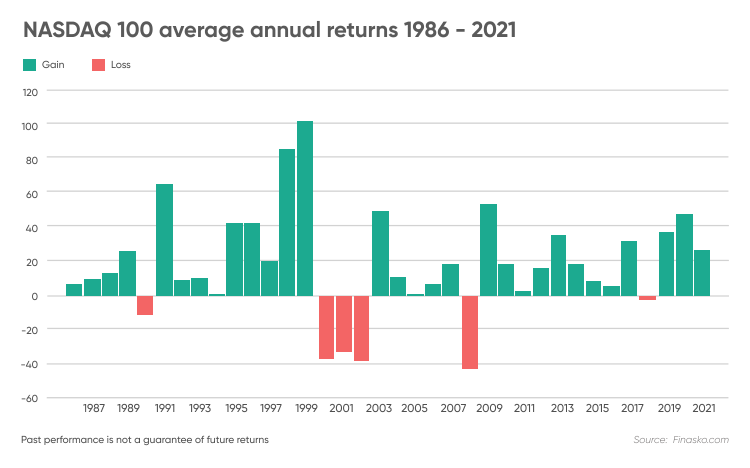

Although the Nasdaq-100 is slightly behind the S&P 500 year-to-date as of March 28, 2024 (up 8.7% vs. 10.6%), it continues to maintain a substantial long-term advantage. Since December 31, 2007, the Nasdaq-100 Total Return™ Index has surged by 929%, more than doubling the S&P 500's total.

Is Nasdaq 100 a buy : The Nasdaq-100, which is comprised of the 100 largest nonfinancial companies listed on the Nasdaq exchange, lost a whopping 33% of its value in 2022, and has rallied 61% since the start of 2023 (as of the closing bell on Feb. 13, 2024). Despite this amazing rally, deals can still be found.

Amidst recent market volatility, the Nasdaq-100 Total Return Index has consistently sustained cumulative total returns exceeding twice the performance of the S&P 500 Total Return Index.

The Nasdaq-100® and S&P 500 stand as two of the most prominent equity indexes in the United States. With its considerable emphasis on innovative sectors like Technology, Consumer Discretionary, and Health Care, the Nasdaq-100 has consistently outperformed the S&P 500 over the past 16 years (12/31/2007 – 3/28/2024).

Is QQQ better than voo

Average Return

In the past year, QQQ returned a total of 39.07%, which is significantly higher than VOO's 30.88% return. Over the past 10 years, QQQ has had annualized average returns of 18.80% , compared to 12.96% for VOO. These numbers are adjusted for stock splits and include dividends.Pure Tech, Pure Growth

When you pit “QQQ vs VGT,” VGT's tech purity stands out. It zeroes in on the tech sector, tracking the performance of the MSCI US Investable Market Information Technology 25/50 Index.NASDAQ-100 Forecast & Price Predictions Summary

Nasdaq-100 price predictions 2024: While it's unlikely investors will experience a gain as large as 2023, the analysts and data suggest investors can still look forward to an upside of +20% next year (if history repeats).

Nasdaq's analyst rating consensus is a Moderate Buy.

What stock will boom in 2024 : Top growth stocks in 2024

| Company | 3-Year Sales Growth CAGR | Industry |

|---|---|---|

| Nvidia (NASDAQ:NVDA) | 39% | Semiconductors |

| Netflix (NASDAQ:NFLX) | 7% | Streaming entertainment |

| Amazon (NASDAQ:AMZN) | 10% | E-commerce and cloud computing |

| Meta Platforms (NASDAQ:META) | 10% | Digital advertising |

How high will the Nasdaq go in 2024 : Here's the Growth Stock to Buy Right Now. The Nasdaq-100 technology index plunged into a bear market in 2022 on the back of a 33% loss for the year.

Should I buy Nasdaq or S&P 500

So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.S&P 500 index funds can help you instantly diversify your portfolio by providing exposure to some of the biggest companies in the U.S. Index funds in general are fairly inexpensive compared with other types of mutual funds, making them an attractive option for most investors.

Is QQQ better than Spy : Average Return. In the past year, QQQ returned a total of 39.07%, which is significantly higher than SPY's 30.74% return. Over the past 10 years, QQQ has had annualized average returns of 18.80% , compared to 12.91% for SPY. These numbers are adjusted for stock splits and include dividends.