Best Performing ETFs Over the Last 10 Years

| | Ticker | 10-Year Performance |

|---|---|---|

| 1 | GBTC | 11,769% |

| 2 | SMH | 1045.4% |

| 3 | XLK | 549.2% |

| 4 | IXN | 480.1% |

In a nutshell, you pay a €1.00 transaction fee for ETFs in the DEGIRO core selection. For all other ETFs, you pay €3.00 per transaction. On top of the transaction fee, there's a connectivity fee of €2.50 per stock exchange per year.Summary of the best investments with 10% ROI

- Private credit.

- Individual stocks.

- Real estate.

- Fine art.

- Debt.

- A business.

- Private startups.

- Cryptocurrencies.

Which ETF gives the highest return : Performance of ETFs

| Schemes | Latest Price | Returns in % (as on May 18, 2024) |

|---|---|---|

| CPSE Exchange Traded Fund | 89.40 | 107.03 |

| Kotak PSU Bank ETF | 707.00 | 76.2 |

| Nippon ETF PSU Bank BeES | 78.90 | 76.09 |

| SBI – ETF Nifty Next 50 | 64.98 |

Are ETF fees worth it

These fees reduce the value of an ETF investment. They're a subset of the total management expense ratio (MER). MERs are generally lower for passive funds than for active ones. Higher fees can have a large impact on overall investment returns because fees compound over time.

Is DEGIRO better than trading 212 : DEGIRO's service is on par with Trading 212's and a comparison of their fees shows that DEGIRO's fees are slightly lower than Trading 212's.

How to invest $10,000: 10 proven strategies

- Pay off high-interest debt.

- Build an emergency fund.

- Open a high-yield savings account.

- Build a CD ladder.

- Get your 401(k) match.

- Max out your IRA.

- Invest through a self-directed brokerage account.

- Invest in a REIT.

While 10% might be the average, the returns in any given year are far from average. In fact, between 1926 and 2024, returns were in that “average” band of 8% to 12% only eight times. The rest of the time they were much lower or, usually, much higher.

What ETF has 12% yield

Top 100 Highest Dividend Yield ETFs

| Symbol | Name | Dividend Yield |

|---|---|---|

| FEPI | REX FANG & Innovation Equity Premium Income ETF | 12.71% |

| QRMI | Global X NASDAQ 100 Risk Managed Income ETF | 12.32% |

| YMAX | YieldMax Universe Fund of Option Income ETFs | 12.30% |

| XRMI | Global X S&P 500 Risk Managed Income ETF | 12.28% |

ETFs are considered to be low-risk investments because they are low-cost and hold a basket of stocks or other securities, increasing diversification. For most individual investors, ETFs represent an ideal type of asset with which to build a diversified portfolio.If you're looking for an easy solution to investing, ETFs can be an excellent choice. ETFs typically offer a diversified allocation to whatever you're investing in (stocks, bonds or both). You want to beat most investors, even the pros, with little effort.

ETFs are designed to track the market, not to beat it

But many ETFs track a benchmarking index, which means the fund often won't outperform the underlying assets in the index. Investors who are looking to beat the market (potentially a riskier approach) may choose to look at other products and services.

Is Trading 212 safe Europe : Your funds and assets are protected by Investors Compensation Fund (ICF) for up to €20,000. You can learn more about how the ICF operates here. In addition to the ICF, we provide our clients with the free private insurance from Lloyd's of London, giving coverage of up to €1 million.

Do people actually make money on Trading 212 : Do people actually make money on Trading 212 Like with any platform, the gains and losses you make will depend on your own investment decisions. No one knows how a company stock will perform in future. CFDs are more risky investments and around four in five investors trading CFDs will lose money.

How to turn 100k into 1 million

There are two approaches you could take. The first is increasing the amount you invest monthly. Bumping up your monthly contributions to $200 would put you over the $1 million mark. The other option would be to try to exceed a 7% annual return with your investments.

To potentially turn $10k into $100k, consider investments in established businesses, real estate, index funds, mutual funds, dividend stocks, or cryptocurrencies. High-risk, high-reward options like cryptocurrencies and peer-to-peer lending could accelerate returns but also carry greater risks.There is no set percentage. Some agencies might be satisfied with a 5-percent ROI, while others might be on the lookout for a higher number like 20 percent for it to be considered good ROI.

Is 7% return on investment realistic : General ROI: A positive ROI is generally considered good, with a normal ROI of 5-7% often seen as a reasonable expectation. However, a strong general ROI is something greater than 10%. Return on Stocks: On average, a ROI of 7% after inflation is often considered good, based on the historical returns of the market.

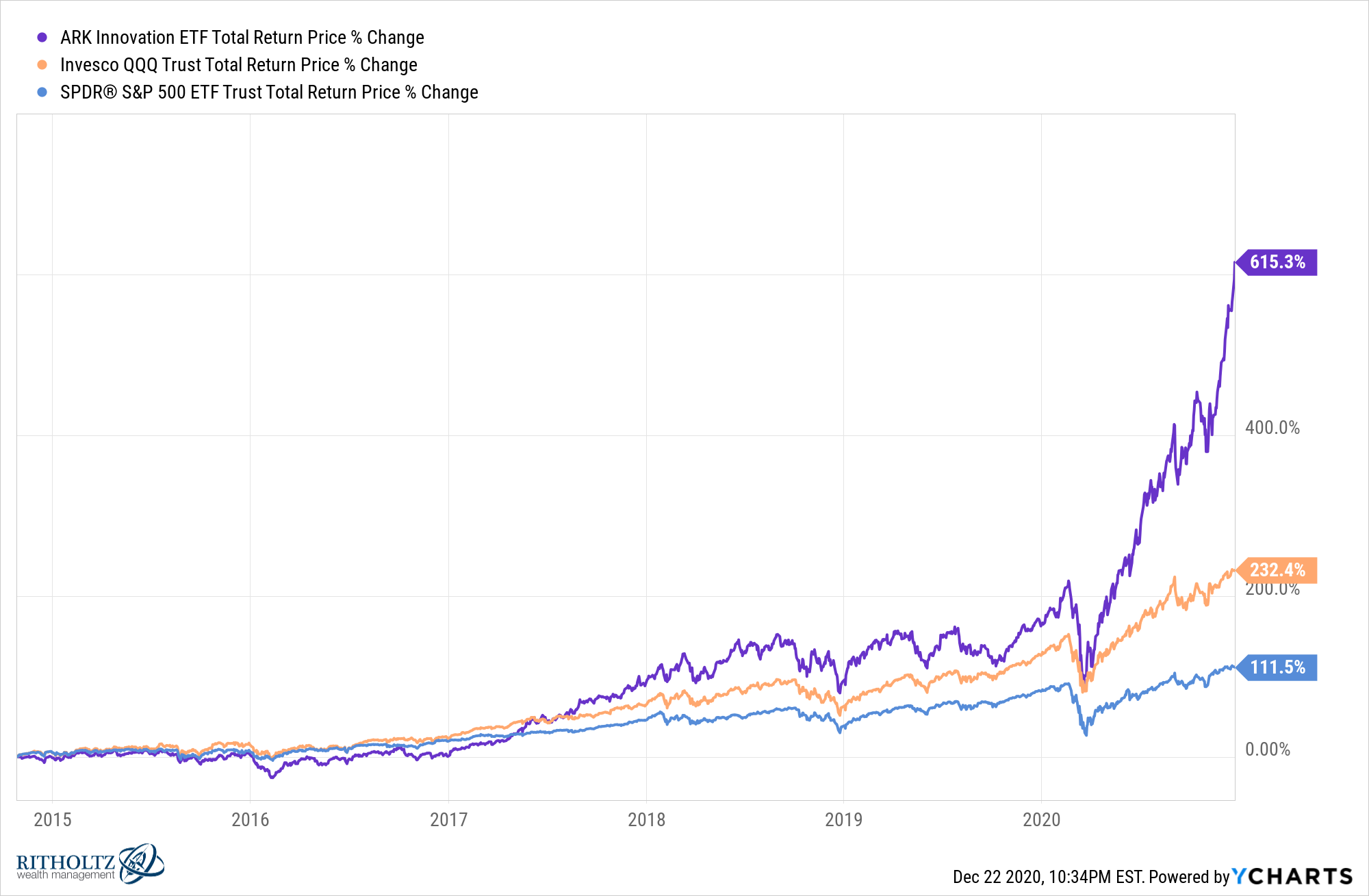

:max_bytes(150000):strip_icc()/TopETFsthroughDec.22021-7388ec5349294c67b33dc6dc2cb8e171.png)