The S&P 500 Index measures the value of the stocks of the 500 largest corporations by market capitalization listed on the New York Stock Exchange or Nasdaq. The intention of Standard & Poor's is to have a price that provides a quick look at the stock market and economy.The S&P 500 index, or Standard & Poor's 500, is a very important index that tracks the performance of the stocks of 500 large-cap companies in the U.S. The ticker symbol for the S&P 500 index is ^GSPC. The series of letters represents the performance of the 500 stocks listed on the S&P.Standard and Poor’s

What Does Standard and Poor's Mean Standard & Poor's (S&P) is a company, a leading index provider, and data source of independent credit ratings.

Why is the S&P 500 important : The S&P 500 is largely considered an essential benchmark index for the U.S. stock market. Composed of 500 large-cap companies across a breadth of industry sectors, the index captures the pulse of the American corporate economy.

What is different about S & P 500

Key Takeaways. The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.

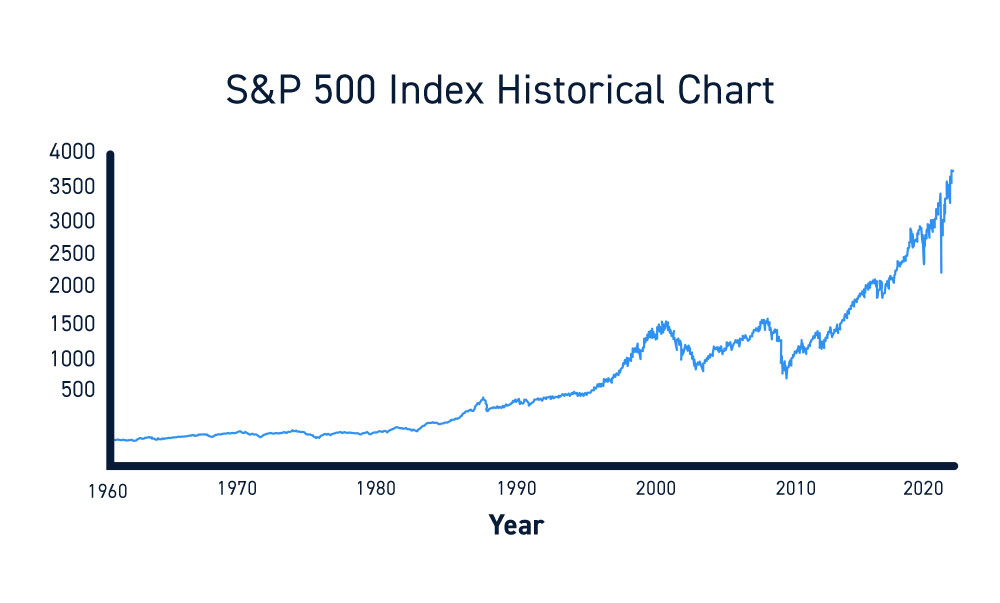

Is investing in the S and P 500 good : Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization. Other indexes, like the Wilshire 5000 and Russell 2000, cover broader market segments.

S&P Global (formerly Standard & Poor's), which sponsors a number of other market indexes—and also operates one of the “Big Three” credit rating agencies—traces its roots to an investment information service begun in 1860 by Henry Varnum Poor. In 1941, Poor's original company, Poor's Publishing, merged with Standard…

Is S&P Global the same as S&P 500

In terms of sector diversification, the S&P Global 100 Index has a broader sector mix than that of the S&P 500. The top 10 holdings span across not just I.T. but also Consumer Discretionary, Energy, Health Care, Consumer Staples, and Financials, as of 30 June 2022.The S&P 500 tracks the performance of about 500 high-value companies in the United States and therefore aims to represent the performance of the U.S stock market and overall U.S. economy. Since so many companies are included in the S&P 500 index, many consider it a great way to diversify an investment portfolio.Several factors influence the index's value besides a company's share price. Instead of adding the constituents' stock prices, the S&P 500 adds the companies' float-adjusted market capitalization. Also, the index does not include gains from cash dividends paid by the companies that comprise the index.

Dow Jones, S&P 500 and Nasdaq Composite simultaneously close at record highs for first time in almost two months. All three major U.S. stock indexes finished at their highest-ever levels on Wednesday, fueled by signs of slowing inflation on a monthly basis in April's consumer price index.

What’s the difference between S&P 500 and S&P 100 : The S&P 100, a subset of the S&P 500, includes 101 (because one of its component companies, Alphabet Inc. – also known as Google – has two classes of stock) leading U.S. stocks with exchange-listed options.

What is a major benefit of owning an S & P 500 index fund : S&P 500 index funds have some of the lowest expense ratios on the market. Index investing is already less expensive than almost any other kind of investing, even if you don't select the cheapest fund.

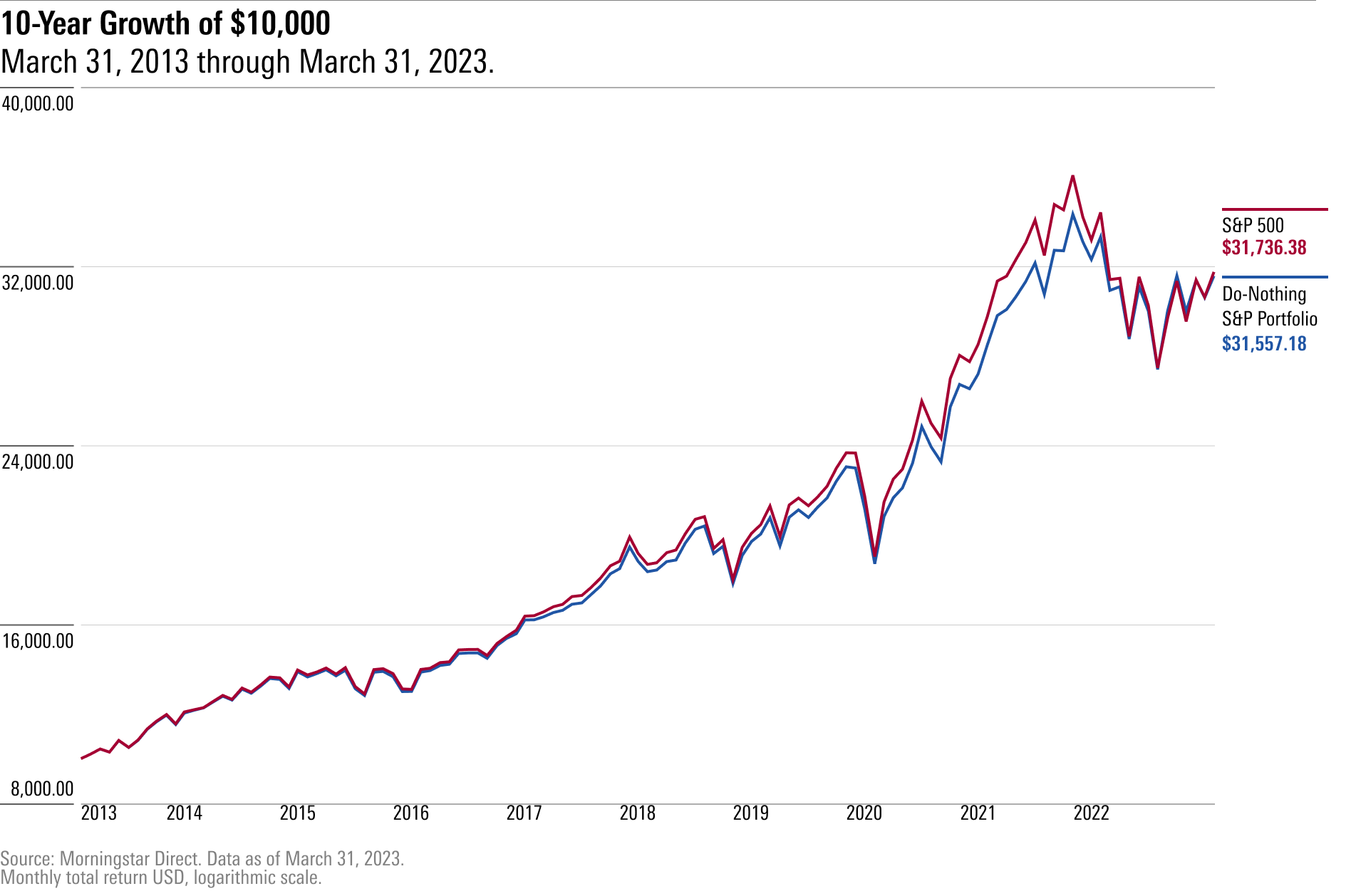

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

Is S and P 500 the same as total stock : Pretty much by definition, the S&P 500 is made up of large-cap companies. A total market index is mostly large-cap stocks, but by definition includes all the mid-cap and small-cap stocks as well.

:max_bytes(150000):strip_icc()/SP-500-Index-d04148d29bca4307b412f4fd91741e17.jpg)