No. The Dow represents only a narrow slice of the economy. Professional investors tend to look at broader measures of the market, such as the S&P 500 index, which has nearly 17 times the number of companies within it.The Dow, for example, has higher weightings in financials, healthcare, consumer discretionary, and industrials than the S&P 500 and Nasdaq Composite, but lower weightings in high-growth sectors like tech and communications (with the latter including Alphabet, Meta Platforms, Netflix, and other growth stocks).In terms of index construction, both The Dow and the S&P 500 track large-cap U.S. stocks. The Dow's components are large and well-known companies that are often described as blue chips. The S&P 500 tracks top companies in leading industries in the large-cap segment of the market as well.

What are the key differences between the S&P 500 and the Dow Jones Industrial Average Chegg : The S&P 500 represents a much fewer number of companies and is weighted based on company stock prices, while the DJIA represents a much larger number of companies and its index is market cap weighted.

Should I invest in S and P index

S&P 500 index funds can help you instantly diversify your portfolio by providing exposure to some of the biggest companies in the U.S. Index funds in general are fairly inexpensive compared with other types of mutual funds, making them an attractive option for most investors.

Why is the Dow so popular : In addition to representing 30 of the most highly capitalized and influential companies in the U.S. economy, the Dow is also the financial media's most referenced U.S. market index and remains a good indicator of general market trends.

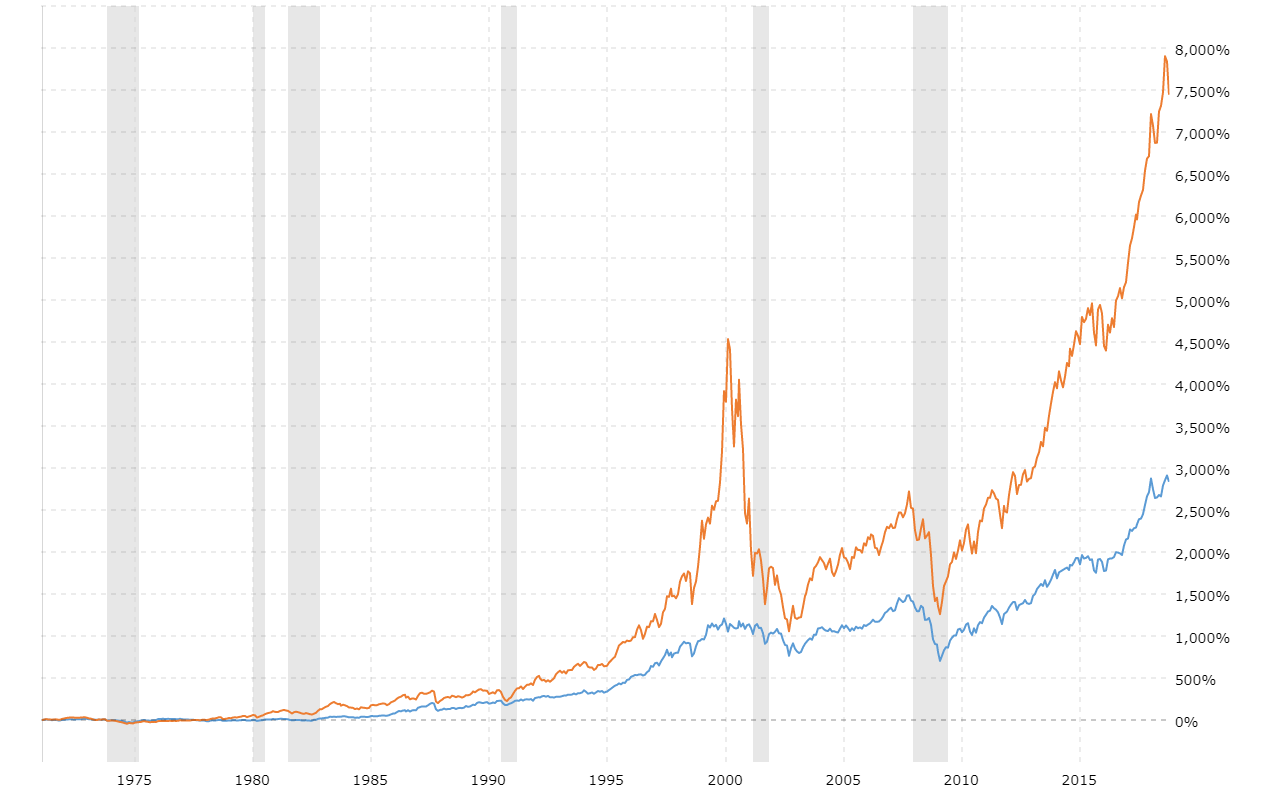

S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has significantly outperformed S&P 500 in terms of performance. Over the past 15 years, Nasdaq 100 has delivered a CAGR of around 16%, while S&P 500 has returned about 8%.

While the Nasdaq is also a stock exchange, the Dow is purely a stock market index. The Dow does include stocks on both the NYSE as well as the Nasdaq, whereas any Nasdaq indexes will include only stocks listed on Nasdaq exchanges.

What is the S and P 500 market called

The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.An S&P 500 index fund is a fund that tracks the S&P 500 — a market index that measures the performance of about 500 U.S. companies. Index funds by definition aim to mirror a particular market index, whether that is the Dow Jones Industrial Average, the Nasdaq Composite Index or the S&P 500.Key Takeaways

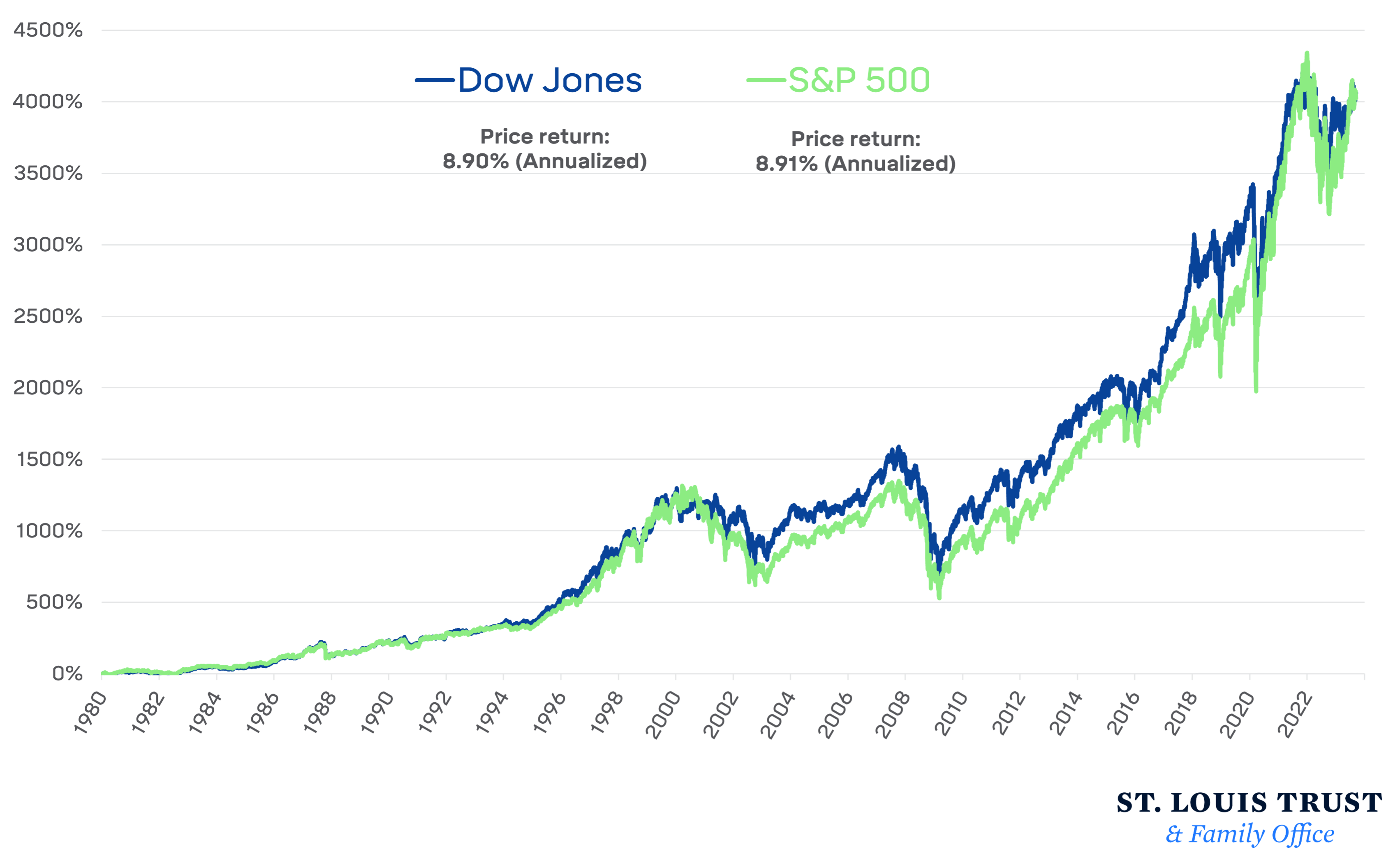

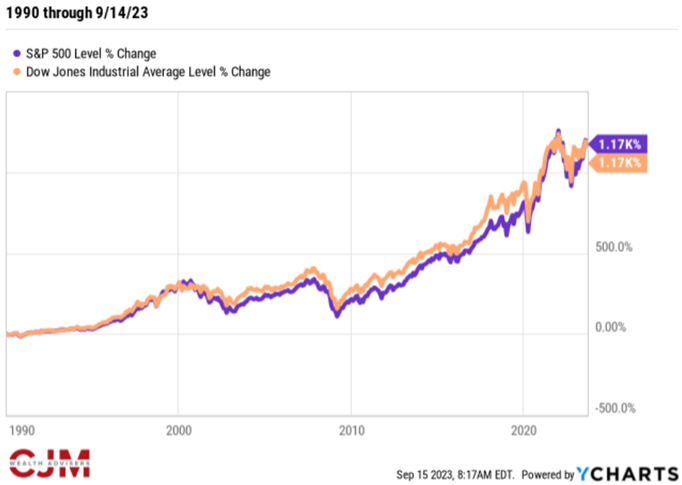

The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.

Benefits of the DJIA

This makes it a reliable indicator of US stock market performance. Secondly, the DJIA is a price-weighted index, which means that stocks with higher share prices have a more significant weight than firms with lower share prices.

What if I invested $1000 in S&P 500 10 years ago : Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

How much will S&P be worth in 10 years : Stock market forecast for the next decade

| Year | Price |

|---|---|

| 2027 | 6200 |

| 2028 | 6725 |

| 2029 | 7300 |

| 2030 | 8900 |

Why does the Dow outperform the S&P

Because of its focus on high-quality, dividend-paying firms (what some might call “blue chip” stocks), the Dow has tended to hold up better than the other indexes in down markets. In 2022, for instance, the Dow lost only 7% compared with a nearly 19% loss in the S&P and a 32% slide in the Nasdaq.

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.Therefore, the downside risk is likely to be higher in case of the Nasdaq 100 when compared S&P 500 index, which has a much broader representation of the US companies across different sectors. So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you.

Is Apple Nasdaq or Dow : What exchange does Apple stock trade on Apple stock is traded on the NASDAQ Global Select Market under the ticker symbol AAPL.