What's the difference between the Nasdaq Composite Index and the Nasdaq-100® Unlike the Nasdaq Composite Index, the Nasdaq-100 does not include the stocks of financial institutions, investment companies or sectors such as oil & gas.Nasdaq-100 Index®

The companies in the Nasdaq-100® includes 100-plus of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market® based on market capitalization. The Nasdaq-100® is one of the world's preeminent large-cap growth indexes.S&P 500 Index Versus Nasdaq 100 Performance

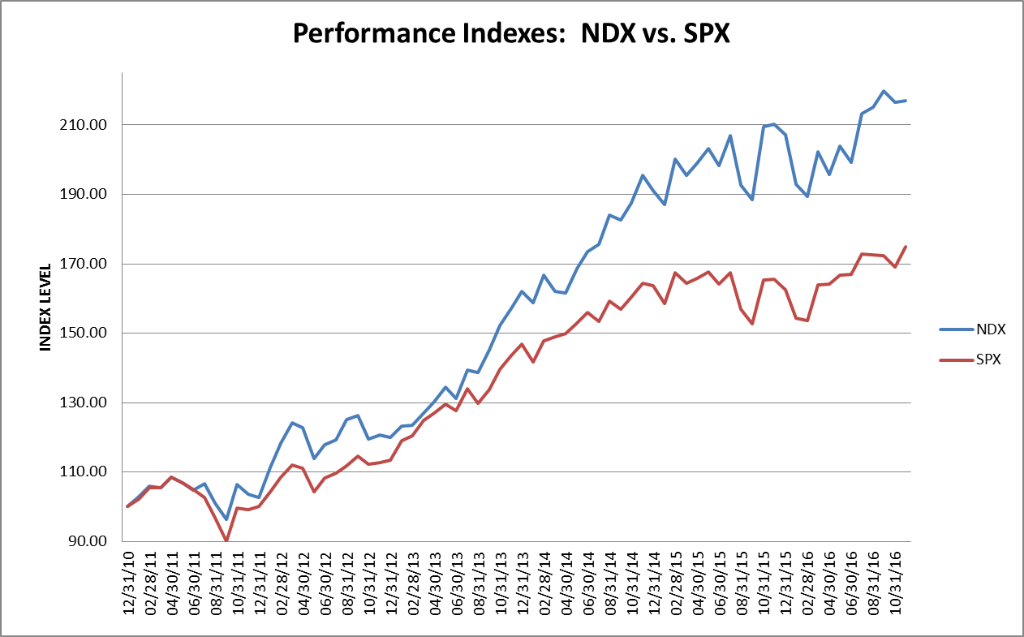

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.

What is the meaning of Nasdaq 100 index : The NASDAQ-100 Index is a stock market index that includes 100 of the largest, most actively traded, non-financial companies that are listed on the Nasdaq Stock Market. A stock market index helps investors compare current and past price levels in order to calculate the overall market's performance.

Is Nasdaq-100 better than S&P 500

The Nasdaq-100® and S&P 500 stand as two of the most prominent equity indexes in the United States. With its considerable emphasis on innovative sectors like Technology, Consumer Discretionary, and Health Care, the Nasdaq-100 has consistently outperformed the S&P 500 over the past 16 years (12/31/2007 – 3/28/2024).

Is Netflix part of Nasdaq-100 : Netflix, Inc. to Join the NASDAQ-100 Index Beginning June 6, 2013 | Nasdaq.

The S&P 500 is considered a better reflection of the market's performance across all sectors compared to the Nasdaq Composite and the Dow.

The Nasdaq-100 is quite different than the S&P 500

But all of the largest companies in the Nasdaq-100 are also included in the S&P 500 index, including Apple, Microsoft, Amazon, Alphabet, Facebook, and (now) Tesla.

Should I invest in S&P 500 or Nasdaq-100

The Nasdaq-100® and S&P 500 stand as two of the most prominent equity indexes in the United States. With its considerable emphasis on innovative sectors like Technology, Consumer Discretionary, and Health Care, the Nasdaq-100 has consistently outperformed the S&P 500 over the past 16 years (12/31/2007 – 3/28/2024).The Nasdaq-100 is quite different than the S&P 500

But all of the largest companies in the Nasdaq-100 are also included in the S&P 500 index, including Apple, Microsoft, Amazon, Alphabet, Facebook, and (now) Tesla.The Nasdaq-100 Index® is designed to measure the performance of 100 of the largest Nasdaq-listed non-financial companies. Eligible security types generally include American Depositary Receipts (ADRs), common stocks, ordinary shares, and tracking stocks.

The US500 (S&P 500) is a market capitalization weighted index of the 500 largest publically traded companies in the U.S. It is also float adjusted, meaning the weight of each individual company is determined by a combination of market capitalization and the number of shares outstanding.

Is Nasdaq-100 same as S&P 500 : The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Why is S&P 500 so strong : Dow Jones, S&P 500 and Nasdaq Composite simultaneously close at record highs for first time in almost two months. All three major U.S. stock indexes finished at their highest-ever levels on Wednesday, fueled by signs of slowing inflation on a monthly basis in April's consumer price index.

Does the S&P 500 include the Nasdaq

How the S&P 500 Works. That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE).

Tesla Inc. Stock Quote (U.S.: Nasdaq)"In my view, for most people, the best thing to do is own the S&P 500 index fund," Buffett had once said. "The trick is not to pick the right company. The trick is to essentially buy all the big companies through the S&P 500 and to do it consistently and to do it in a very, very low-cost way," he further added.

Is S&P 500 or Nasdaq 100 better : Amidst recent market volatility, the Nasdaq-100 Total Return Index has consistently sustained cumulative total returns exceeding twice the performance of the S&P 500 Total Return Index.