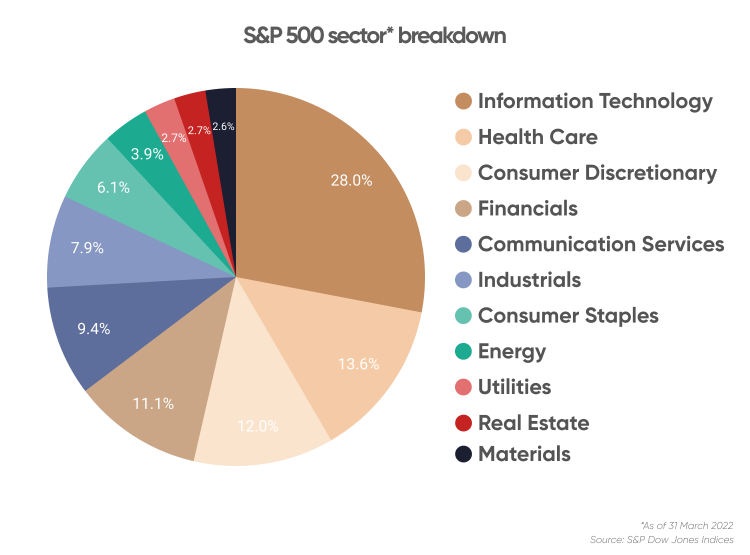

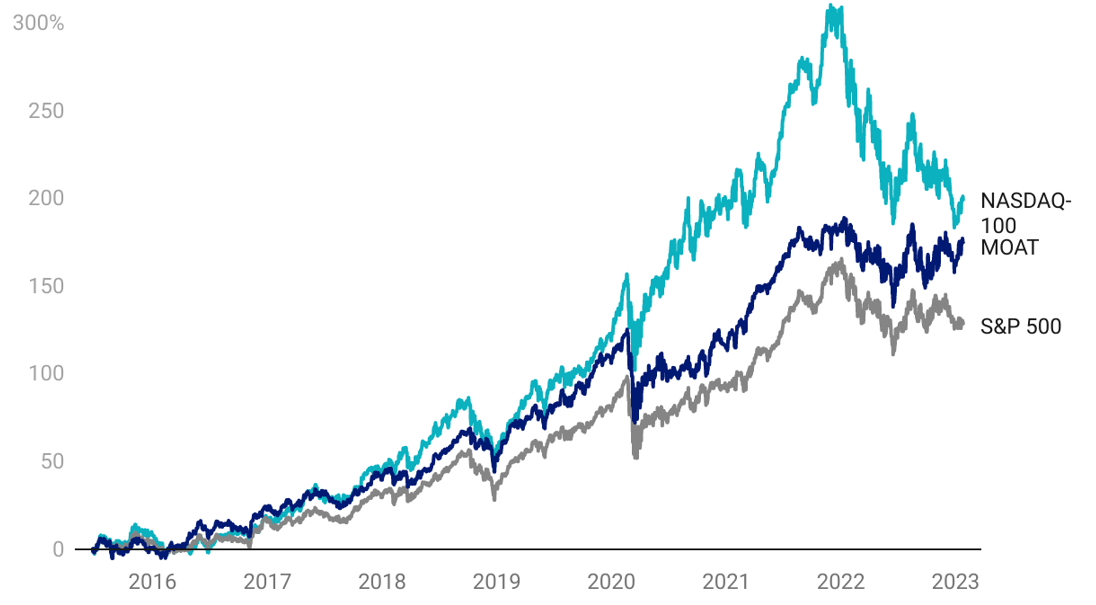

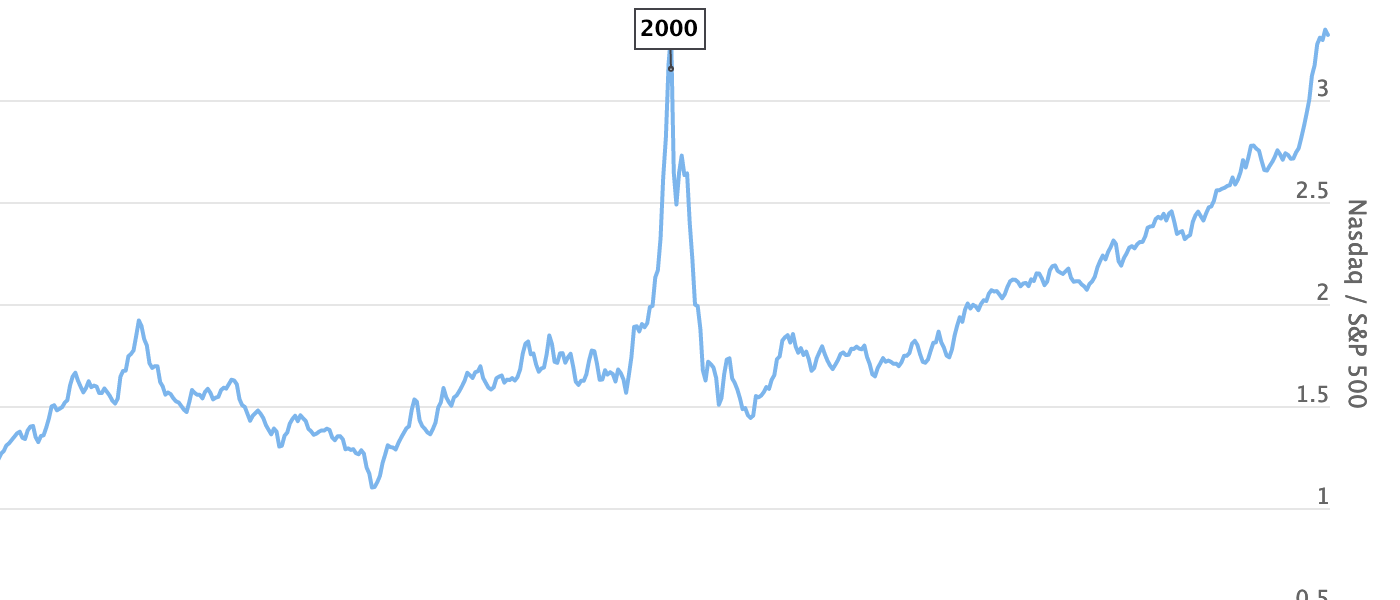

The Nasdaq is another kind of scoreboard that looks at tech companies, and it has a lot more companies than the Dow. The S&P 500 includes 500 large companies and gives a broader look at the stock market. Understanding these indices is important for those interested in investing in US stocks.So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.The Nasdaq-100 is heavily allocated towards top-performing industries such as Technology, Consumer Discretionary, and Health Care, which have helped the Nasdaq-100 outperform the S&P 500 by a wide margin between December 31, 2007, and March 31, 2023.

Are all Nasdaq 100 companies in the S&P 500 : The Nasdaq-100 is quite different than the S&P 500

But all of the largest companies in the Nasdaq-100 are also included in the S&P 500 index, including Apple, Microsoft, Amazon, Alphabet, Facebook, and (now) Tesla.

Are all S&P 500 the same

Not all index ETFs precisely replicate the index. With more than 500 stocks to own, an S&P 500 index ETF may instead choose to hold only the most important or heavily-weighted stocks in the index. This can result in the ETF returning slightly differently from the benchmark index.

Is there an overlap between Nasdaq and S&P 500 : The S&P500 and the NASDAQ are both indices of stocks and there's a lot of overlap between the 2. Many of the top 10 stocks are the same, so if you're invested in both, you may not be as diversified as you think.

The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization. Other indexes, like the Wilshire 5000 and Russell 2000, cover broader market segments.

The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Is it better to invest in Nasdaq or S&P

The S&P 500 is considered a better reflection of the market's performance across all sectors compared to the Nasdaq Composite and the Dow. The downside to having more sectors included in the index is that the S&P 500 tends to be more volatile than the Dow.Amidst recent market volatility, the Nasdaq-100 Total Return Index has consistently sustained cumulative total returns exceeding twice the performance of the S&P 500 Total Return Index.What's the difference between the Nasdaq Composite Index and the Nasdaq-100® Unlike the Nasdaq Composite Index, the Nasdaq-100 does not include the stocks of financial institutions, investment companies or sectors such as oil & gas.

You can use an S&P 500 index fund for a high-conviction, long-term bet on U.S. large-cap stocks. Our recommendation for the best overall S&P 500 index fund is the Fidelity 500 Index Fund. With a 0.015% expense ratio, it's the cheapest on our list.

What are the different types of S&P 500 : Here are a few of the most popular S&P 500 ETFs:

- SPY: The State Street SPDR S&P 500 ETF was the original exchange-traded fund and remains one of the most liquid S&P ETFs.

- VOO: VOO is Vanguard's main S&P 500 ETF.

- IVV: iShares' S&P 500 ETF is comparable to the Vanguard product, including that 0.03% expense ratio.

Can stocks be in both Nasdaq and S&P : Because nearly half of the exchange by weight is made up of tech companies, the Nasdaq is widely considered a better gauge for the technology industry. Some of these companies may also be included on the Dow, the S&P 500, or both.

What is better than S and P 500

The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

The S&P 500 weighting system gives a small number of companies major influence, which could have an undue negative effect on the index if one or a few of them run into trouble. The index does not expose investors to small or emerging companies with the potential for market-beating growth.Key Points. The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Which SP 500 is the best : Top S&P 500 index funds in 2024

| Fund (ticker) | 5-year annual returns | Expense ratio |

|---|---|---|

| iShares Core S&P 500 ETF (IVV) | 14.5% | 0.03% |

| Schwab S&P 500 Index (SWPPX) | 14.5% | 0.02% |

| Vanguard 500 Index Fund (VFIAX) | 14.5% | 0.04% |

| Fidelity 500 index fund (FXAIX) | 14.5% | 0.015% |