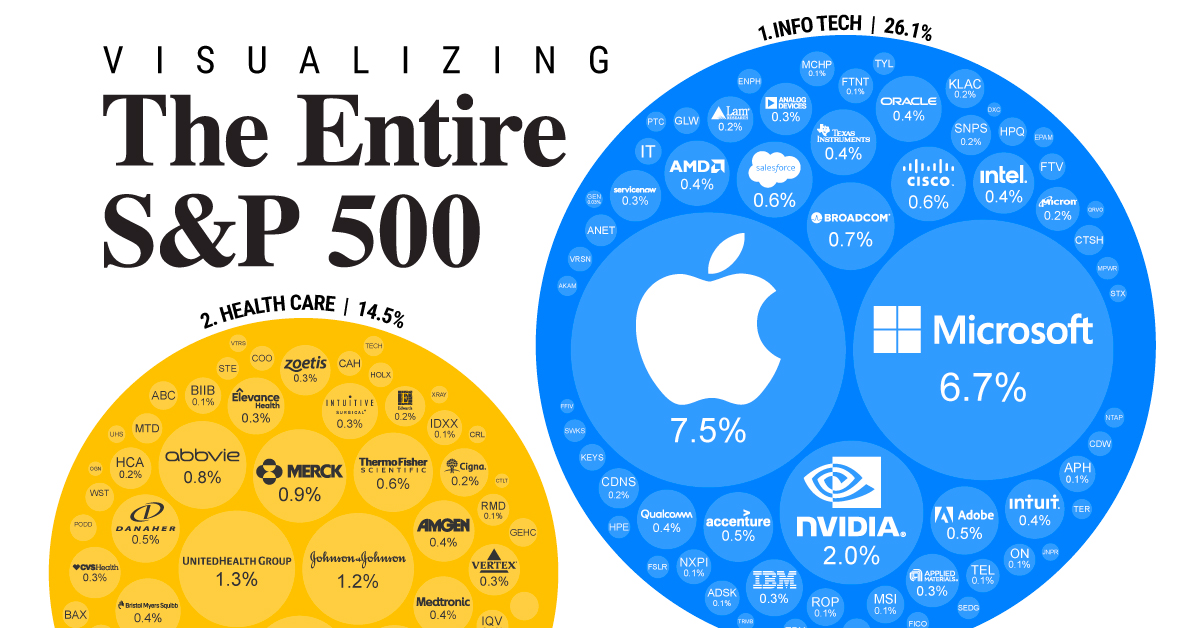

S&P 500 companies by weight

- Key points. The S&P 500 index is often used as a proxy for the broader U.S. stock market.

- Microsoft (MSFT) Index weight: 7.09%

- Apple (AAPL) Index weight: 5.65%

- Nvidia Corp. (NVDA)

- Amazon.com Inc (AMZN)

- Meta Platforms Class A (META)

- Alphabet Class A (GOOGL)

- Berkshire Hathaway Class B (BRK.B)

Changes to the S&P 500 are generally made in response to corporate actions and market developments, and may be made at any time. The index's methodology provides specific guidelines for deleting a company, for example, if its stock has been delisted or the company has declared bankruptcy.The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

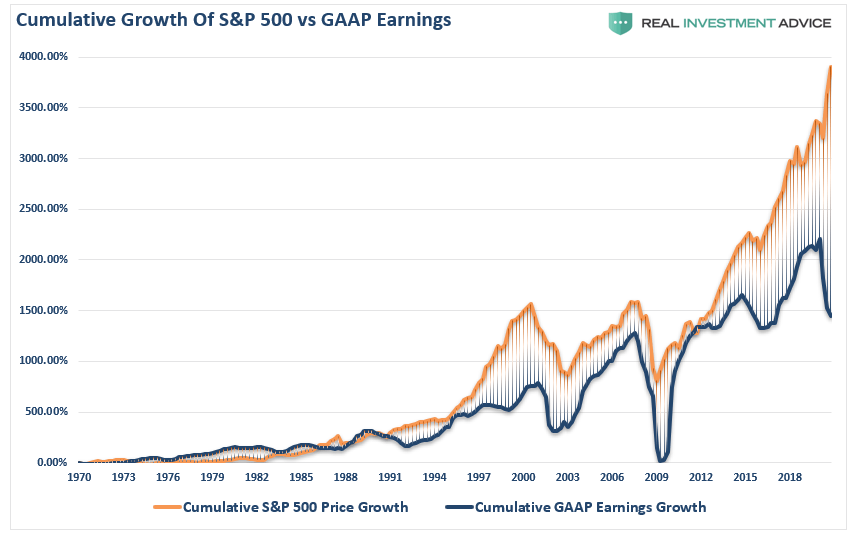

Has the S&P 500 ever lost : Since its inception in 1957, there have only been two occasions in which the S&P 500 fell for two (or more) consecutive years. The index posted back-to-back declines in 1973 and 1974, and it fell for three consecutive years between 2000 and 2002.

What is the smallest S&P 500 company

- 10 Smallest Companies in the S&P500 Index. Business & Books. ·

- 495. Comerica Inc. ($CMA)

- 496. Mohawk Industries Inc. ($MHK)

- 497. Organon & Co ($OGN) Sector: Healthcare.

- 498. Ralph Lauren Corp ($RL) Sector: Consumer Cyclical.

- 499. Zions Bancorp ($ZION)

- 500. Fox Corp Class B ($FOX)

- 501. Lincoln National Corp ($LNC)

Does Warren Buffett own S and P 500 : He holds nearly 40,000 shares of the SPDR S&P 500 ETF Trust (NYSE:SPY), valued at approximately $18.73 million. He has also maintained a stake in the Vanguard S&P 500 ETF (NYSE:VOO), holding 43,000 shares valued at $18.78 million.

Each year, about 20 to 25 stocks leave the S&P 500 and are replaced with other stocks that meet the guidelines for index membership. These changes usually are announced five trading days before the index change.

But if researching and staying up to date on individual companies and their stocks isn't for you, you can still earn great returns by investing in a simple, broad-based index fund like the Vanguard S&P 500 ETF (VOO 0.19%).

Will the S&P 500 ever hit $5,000

Yet, while some strategists see reasons for cheer, others see a market top. On Thursday, the S&P 500 crossed the 5000 mark during intraday trading for the first time, and on Friday it ended above that level, notching its tenth record close of 2024 at 5,026.NEW YORK, Feb 8 (Reuters) – As the S&P 500 continues to hit fresh milestones with a first-ever break above the 5,000 level, its valuation is reaching new heights as well.Our recommendation for the best overall S&P 500 index fund is the Fidelity 500 Index Fund. With a 0.015% expense ratio, it's the cheapest on our list. And it doesn't have a minimum initial investment requirement, sales loads or trading fees. Over the last 10 years, FXAIX has returned an annualized 12.02%.

Thanks to the surging popularity of its index funds, Vanguard is now the No. 1 owner of 330 stocks in the S&P 500, or two-thirds of the world's most important collection of stocks, says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith.

Why buy VOO instead of SPY : Vanguard S&P offers a lower expense ratio (0.035%) than SPY (0.095%), which means lower costs for investors and potentially higher net returns over the long term. VOO might be the more economical choice for cost-conscious investors, especially those investing large sums or planning for long-term goals like retirement.

What is the smallest company in the S&P 500 :

- 10 Smallest Companies in the S&P500 Index. Business & Books. ·

- 495. Comerica Inc. ($CMA)

- 496. Mohawk Industries Inc. ($MHK)

- 497. Organon & Co ($OGN) Sector: Healthcare.

- 498. Ralph Lauren Corp ($RL) Sector: Consumer Cyclical.

- 499. Zions Bancorp ($ZION)

- 500. Fox Corp Class B ($FOX)

- 501. Lincoln National Corp ($LNC)

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

The S&P 500 could hit 10,000 by the mid-2030s. In the following pages we present our analysis, which draws on four key observations: • The historical pattern of market returns suggests strong future returns. Equity valuation is attractive relative to other assets.If the S&P 500 does compound 9.2% annually over the next 10 years, it will reach 10,000 by 2033, Colas wrote Friday.

Should I invest $10,000 in S&P 500 : Assuming an average annual return rate of about 10% (a typical historical average), a $10,000 investment in the S&P 500 could potentially grow to approximately $25,937 over 10 years.