Best Performing ETFs Over the Last 10 Years

| | Ticker | 10-Year Performance |

|---|---|---|

| 1 | GBTC | 11,769% |

| 2 | SMH | 1045.4% |

| 3 | XLK | 549.2% |

| 4 | IXN | 480.1% |

Most Popular ETFs by AUM

| Ticker | Fund | AUM |

|---|---|---|

| SPY | SPDR S&P 500 ETF Trust | $363.23B |

| IVV | iShares Core S&P 500 ETF | $300.18B |

| VTI | Vanguard Total Stock Market ETF | $288.78B |

| VOO | Vanguard S&P 500 ETF | $286.59B |

U.S. ETF Movers

| ETF | Price | Average Volume |

|---|---|---|

| SPY SPDR S&P 500 ETF Trust | $500.97 | 72.74M |

| QQQ Invesco QQQ Trust | $422.80 | 46.09M |

| IWM iShares Russell 2000 ETF | $195.42 | 36.91M |

| IVV iShares Core S&P 500 ETF | $503.24 | 5.75M |

How many ETFs should I invest in : Experts agree that for most personal investors, a portfolio comprising 5 to 10 ETFs is perfect in terms of diversification.

Where to invest to get 10% annual return

Summary of the best investments with 10% ROI

- Private credit.

- Individual stocks.

- Real estate.

- Fine art.

- Debt.

- A business.

- Private startups.

- Cryptocurrencies.

What ETF is better than the S&P 500 : Sector ETFs are another way to beat the S&P 500. While no single sector will beat the broad-market index all the time, investing in sector ETFs can pay off. With geopolitical tensions in the world, defense stocks are up this year, and that has made the Global X Defense Tech ETF (SHLD 0.32%) a winner.

Before purchasing an ETF there are five factors to take into account 1) performance of the ETF 2) the underlying index of the ETF 3) the ETF's structure 4) when and how to trade the ETF and 5) the total cost of the ETF.

100 Highest 5 Year ETF Returns

| Symbol | Name | 5-Year Return |

|---|---|---|

| FNGO | MicroSectors FANG+ Index 2X Leveraged ETNs | 51.20% |

| GBTC | Grayscale Bitcoin Trust | 44.06% |

| TECL | Direxion Daily Technology Bull 3X Shares | 43.35% |

| SOXL | Direxion Daily Semiconductor Bull 3x Shares | 37.24% |

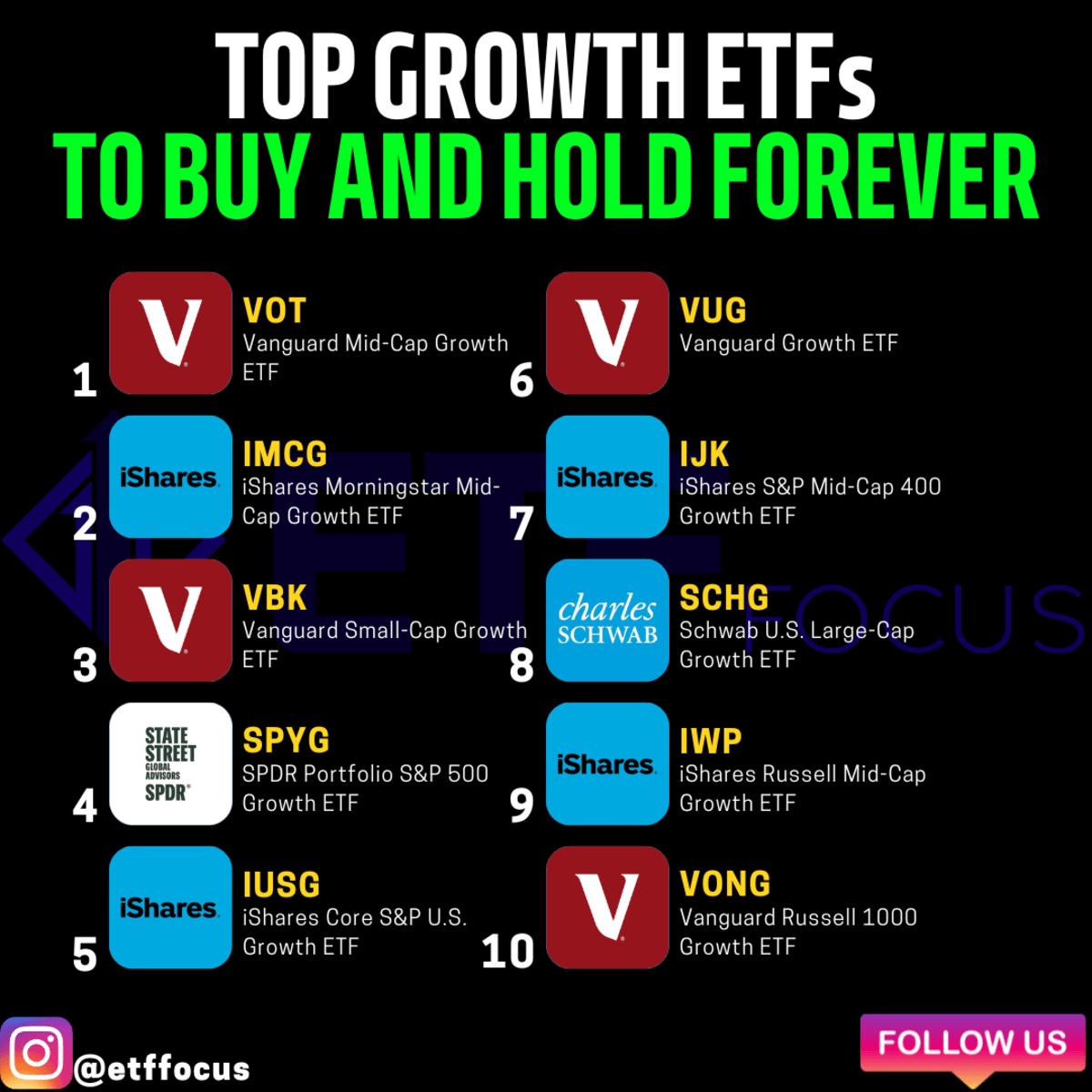

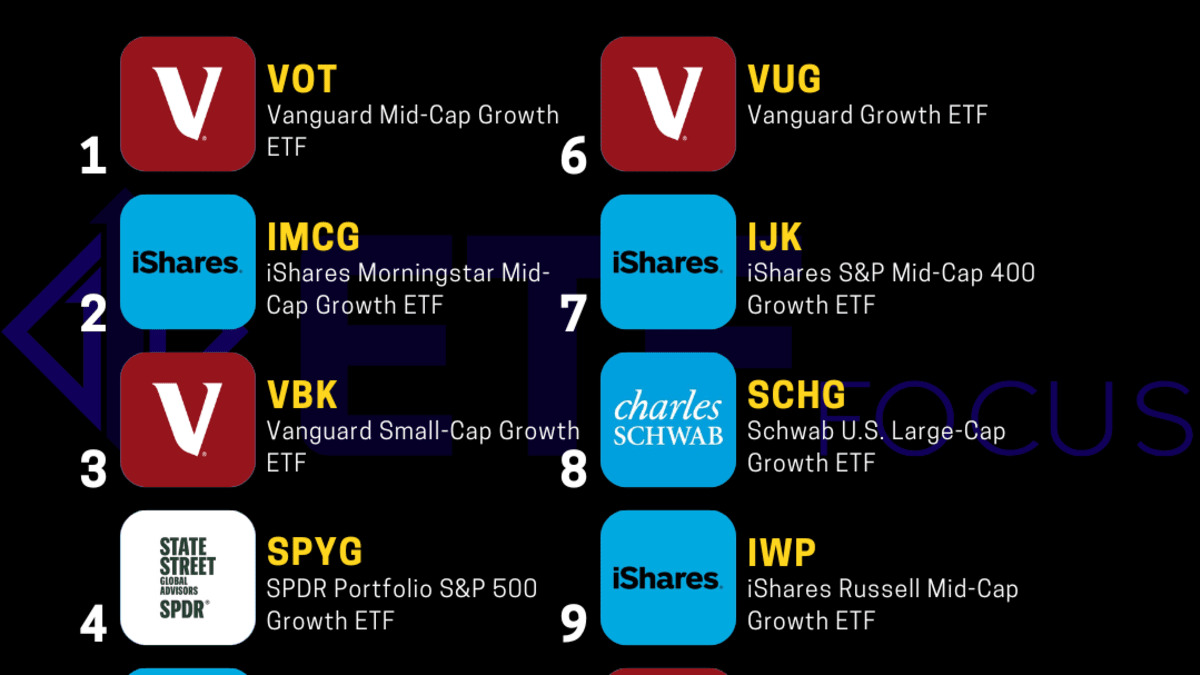

Which ETF is best to invest in

List of 15 Best ETFs in India

- Nippon India ETF Nifty 50 BeES. ₹ 241.63.

- Nippon India ETF PSU Bank BeES. ₹ 76.03.

- BHARAT 22 ETF. ₹ 96.10.

- Mirae Asset NYSE FANG+ ETF. ₹ 84.5.

- UTI S&P BSE Sensex ETF. ₹ 781.

- Nippon India ETF Gold BeES. ₹ 55.5.

- Nippon India Etf Nifty Bank Bees. ₹ 471.9.

- HDFC Nifty50 Value 20 ETF. ₹ 123.2.

Generally speaking, fewer than 10 ETFs are likely enough to diversify your portfolio, but this will vary depending on your financial goals, ranging from retirement savings to income generation.SPY, VOO and IVV are among the most popular S&P 500 ETFs. These three S&P 500 ETFs are quite similar, but may sometimes diverge in terms of costs or daily returns. Investors generally only need one S&P 500 ETF.

How to invest $10,000: 10 proven strategies

- Pay off high-interest debt.

- Build an emergency fund.

- Open a high-yield savings account.

- Build a CD ladder.

- Get your 401(k) match.

- Max out your IRA.

- Invest through a self-directed brokerage account.

- Invest in a REIT.

Is a 10% annual return realistic : While 10% might be the average, the returns in any given year are far from average. In fact, between 1926 and 2024, returns were in that “average” band of 8% to 12% only eight times. The rest of the time they were much lower or, usually, much higher.

What gives better returns than S&P 500 : The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Should I buy SPY or Voo

If you are a cost-conscious investor, the VOO, IVV, and SPLG might make a more attractive option compared to SPY with their lower expense ratios. Conversely, you might appreciate the higher liquidity of SPY if you're an active or institutional trader.

The majority of individual investors should, however, seek to hold 5 to 10 ETFs that are diverse in terms of asset classes, regions, and other factors. Investors can diversify their investment portfolio across several industries and asset classes while maintaining simplicity by buying 5 to 10 ETFs.If you're looking for an easy solution to investing, ETFs can be an excellent choice. ETFs typically offer a diversified allocation to whatever you're investing in (stocks, bonds or both). You want to beat most investors, even the pros, with little effort.

What ETF has 12% yield : Top 100 Highest Dividend Yield ETFs

| Symbol | Name | Dividend Yield |

|---|---|---|

| FEPI | REX FANG & Innovation Equity Premium Income ETF | 12.71% |

| QRMI | Global X NASDAQ 100 Risk Managed Income ETF | 12.32% |

| YMAX | YieldMax Universe Fund of Option Income ETFs | 12.30% |

| XRMI | Global X S&P 500 Risk Managed Income ETF | 12.28% |