Largest ETFs: Top 100 ETFs By Assets

| Symbol | Name | AUM |

|---|---|---|

| SPY | SPDR S&P 500 ETF Trust | $525,769,000.00 |

| IVV | iShares Core S&P 500 ETF | $463,097,000.00 |

| VOO | Vanguard S&P 500 ETF | $448,152,000.00 |

| VTI | Vanguard Total Stock Market ETF | $393,402,000.00 |

The Invesco S&P 500® Top 50 ETF (Fund) is based on the S&P 500® Top 50 Index (Index). The Fund will invest at least 90% of its total assets in securities that comprise the Index. The Index is composed of 50 of the largest companies in the S&P 500® Index. The Fund and the Index are rebalanced annually.Experts agree that for most personal investors, a portfolio comprising 5 to 10 ETFs is perfect in terms of diversification. But the number of ETFs is not what you should be looking at.

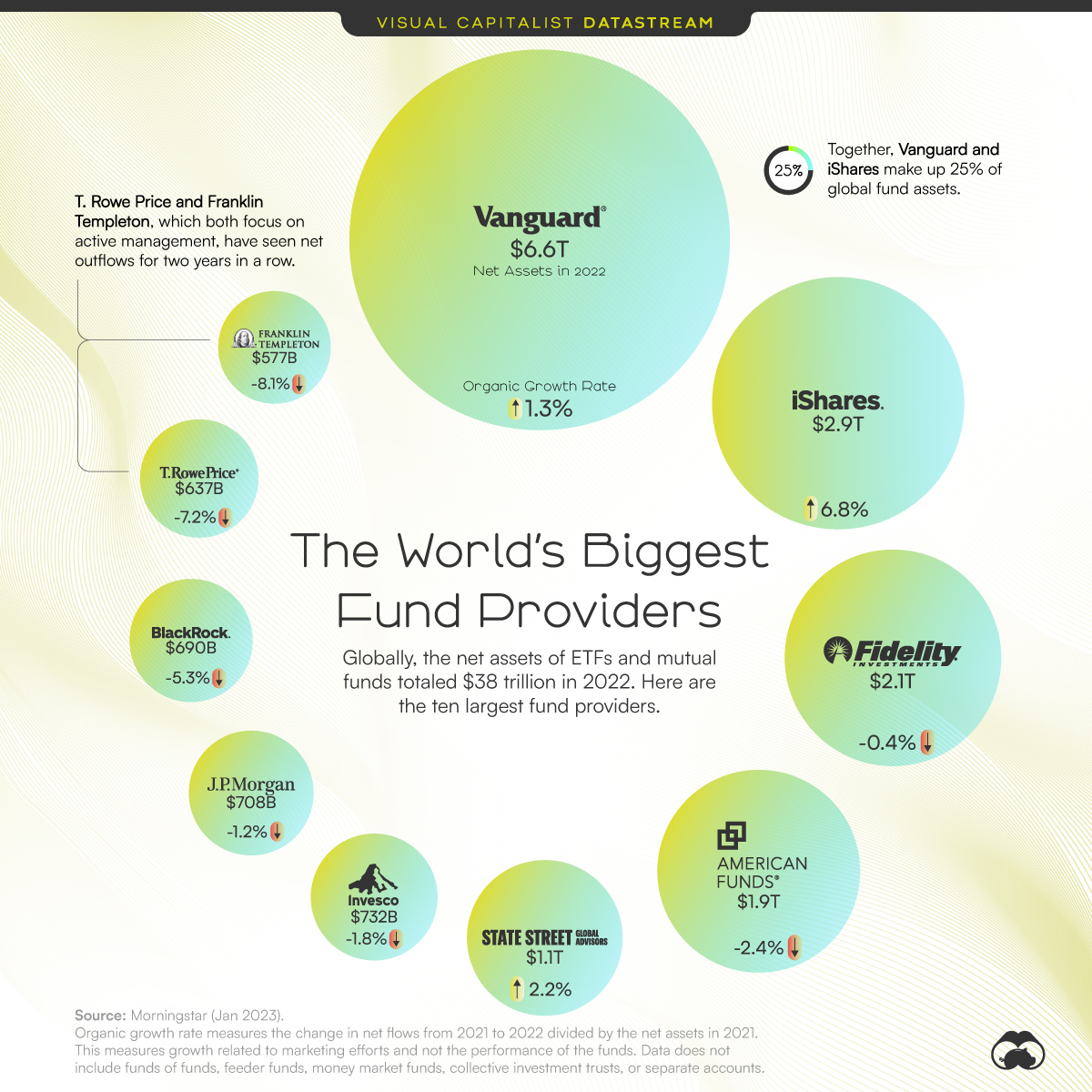

Who are the Big 5 ETF issuers : The Big 5 ETF Issuers

- iShares (BlackRock): $2.59 trillion.

- Vanguard: $2.36 trillion.

- SPDR (State Street): $1.22 trillion.

- Invesco: $454.78 billion.

- Charles Schwab: $320.21 billion3.

What is the most successful ETF

1. VanEck Semiconductor ETF. The VanEck Semiconductor ETF (SMH) tracks a market-cap-weighted index of 25 of the largest U.S.-listed semiconductors companies. Midcap companies and foreign companies listed in the U.S. can also be included in the index.

Is 3 ETFs enough : For most personal investors, an optimal number of ETFs to hold would be 5 to 10 across asset classes, geographies, and other characteristics.

Generally speaking, fewer than 10 ETFs are likely enough to diversify your portfolio, but this will vary depending on your financial goals, ranging from retirement savings to income generation.

Generally speaking, fewer than 10 ETFs are likely enough to diversify your portfolio, but this will vary depending on your financial goals, ranging from retirement savings to income generation.

What ETF does BlackRock own

BlackRock ETF List

| Name | Ticker | Morningstar Category |

|---|---|---|

| BlackRock Short Duration Bond ETF | NEAR | Ultrashort Bond |

| BlackRock Short Maturity Muncpl Bd ETF | MEAR | Muni National Short |

| BlackRock U.S. Equity Factor Rttn ETF | DYNF | Large Blend |

| BlackRock Ultra Short-Term Bond ETF | ICSH | Ultrashort Bond |

The largest Aggressive ETF is the iShares Core Aggressive Allocation ETF AOA with $1.88B in assets. In the last trailing year, the best-performing Aggressive ETF was EAOA at 17.76%. The most recent ETF launched in the Aggressive space was the iShares ESG Aware Aggressive Allocation ETF EAOA on 06/12/20.Best Performing ETFs Over the Last 10 Years

| | Ticker | 10-Year Performance |

|---|---|---|

| 1 | GBTC | 11,769% |

| 2 | SMH | 1045.4% |

| 3 | XLK | 549.2% |

| 4 | IXN | 480.1% |

Experts agree that for most personal investors, a portfolio comprising 5 to 10 ETFs is perfect in terms of diversification.

How many S&P 500 ETFs should I own : SPY, VOO and IVV are among the most popular S&P 500 ETFs. These three S&P 500 ETFs are quite similar, but may sometimes diverge in terms of costs or daily returns. Investors generally only need one S&P 500 ETF.

Did BlackRock buy iShares : iShares is a collection of exchange-traded funds (ETFs) managed by BlackRock, which acquired the brand and business from Barclays in 2009.

What is the best performing ETF

10 Best-Performing ETFs of 2024

| ETF | Expense Ratio | Assets Under Management |

|---|---|---|

| VanEck Semiconductor ETF (SMH) | 0.35% | $17.9 billion |

| Simplify Interest Rate Hedge ETF (PFIX) | 0.50% | $163 million |

| Global X Copper Miners ETF (COPX) | 0.65% | $2.3 billion |

| Invesco S&P MidCap Momentum ETF (XMMO) | 0.34% | $2.1 billion |

7 risky leveraged ETFs to watch:

- ProShares UltraPro QQQ (TQQQ)

- ProShares Ultra QQQ (QLD)

- Direxion Daily S&P 500 Bull 3x Shares (SPXL)

- Direxion Daily S&P 500 Bull 2x Shares (SPUU)

- Amplify BlackSwan Growth & Treasury Core ETF (SWAN)

- WisdomTree U.S. Efficient Core Fund (NTSX)

Summary of the best investments with 10% ROI

- Private credit.

- Individual stocks.

- Real estate.

- Fine art.

- Debt.

- A business.

- Private startups.

- Cryptocurrencies.

Which is better, Vanguard or BlackRock : Vanguard Surpasses BlackRock for Top Spot in Asset Management Brand Ranking. The Broadridge Fund Brand 50 report shows the influence of brand on third-party fund selection. The Vanguard Group has edged BlackRock Inc. for the top spot in an annual fund investor survey gauging sentiment toward the largest asset managers.