The Nasdaq-100® and S&P 500 stand as two of the most prominent equity indexes in the United States. With its considerable emphasis on innovative sectors like Technology, Consumer Discretionary, and Health Care, the Nasdaq-100 has consistently outperformed the S&P 500 over the past 16 years (12/31/2007 – 3/28/2024).A popular and effective way to invest in the Nasdaq is via either an exchange-traded fund (ETF) or an index tracker fund. These are 'passive' investments which rely on computer algorithms to replicate a particular index.Nasdaq's NDAQ impressive organic growth, ramping up of on-trading revenue base, strategic buyouts to capitalize on growing market opportunities and effective capital deployment make it worth retaining in one's portfolio. Nasdaq has a decent track record of beating estimates in the last three reported quarters of 2023.

What is the return of the Nasdaq-100 index : Annual returns

So far in 2024 (YTD), the Nasdaq-100 index has returned an average 7.05%.

Is now a good time to invest in Nasdaq

In sum, now is not the worst time to buy stocks in history — far from it. But given higher prices, knowing what a company does and why you want to own a piece of it is especially important.

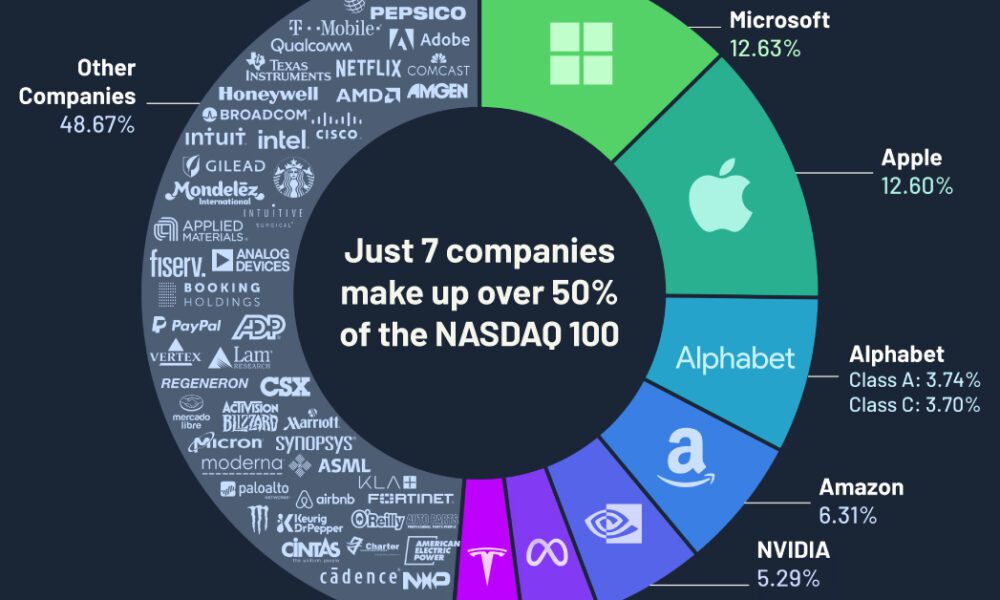

Is investing in Nasdaq safe : The long-term value you can receive from investing in the Nasdaq-100 is generally worth that trade-off. Many of the top holdings in the Invesco QQQ ETF overlap those in S&P 500 and weigh heavily in both, so if you're an investor in both, be mindful of your diversification.

Don't let fears of near-term drops distract you from potentially decades of change and growth. Ignore short-term noise and invest expecting long-term results. It's not too late to invest in the Nasdaq-100. You've got time before 2024 starts, and after the year is underway.

Performance Of Nasdaq 100 Index

The Nasdaq 100 index has done well in recent years when compared to Indian equity markets. Nasdaq 100 TRI index has delivered a CAGR of 34.6% over the past 5 years, while the NIFTY 50 TRI index has delivered a CAGR of 18.8%.

Is Nasdaq 100 high risk

Therefore, the downside risk is likely to be higher in case of the Nasdaq 100 when compared S&P 500 index, which has a much broader representation of the US companies across different sectors. So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you.NASDAQ-100 Forecast & Price Predictions Summary

Nasdaq-100 price predictions 2024: While it's unlikely investors will experience a gain as large as 2023, the analysts and data suggest investors can still look forward to an upside of +20% next year (if history repeats).It recently reported its earnings for the second quarter of fiscal 2024. Revenue grew 103% year over year to $3.66 billion, and 73% over the prior quarter. This is exponential growth from a multibillion-dollar corporation, and management is guiding for over 200% year-over-year growth in the third quarter.

The Nasdaq 100 price prediction from Long Forecast Agency is bullish, predicting that the index could close Q2 2024 at 19,600 and trade above 20,000 points during 2024. The NASDAQ 5-year forecast is also bullish, with the Tech index expected to trade as high as +30,000 points.

How high will the Nasdaq go in 2024 : Here's the Growth Stock to Buy Right Now. The Nasdaq-100 technology index plunged into a bear market in 2022 on the back of a 33% loss for the year.

Is it risky to invest in Nasdaq : It's safe to invest in the stocks that make up the Nasdaq 100 — as long as you have a long time horizon. Historically, the Nasdaq 100 has smashed the S&P 500 in terms of returns. But tech stocks tend to be more volatile than the overall stock market and perform especially poorly during recessions.

Is Nasdaq index fund risky

Lower risk: Because they're diversified, investing in an index fund is lower risk than owning a few individual stocks. That doesn't mean you can't lose money or that they're as safe as a CD, for example, but the index will usually fluctuate a lot less than an individual stock.

About half of the NASDAQ index does not pay a dividend. The companies that do offer shareholders a dividend tend to offer low yielding dividends. In comparison, the S&P 500 has over 400 companies that pay dividends and all 30 components of the Dow pay a dividend. Here is an overview of the NASDAQ dividend yield.Top growth stocks in 2024

| Company | 3-Year Sales Growth CAGR | Industry |

|---|---|---|

| Nvidia (NASDAQ:NVDA) | 39% | Semiconductors |

| Netflix (NASDAQ:NFLX) | 7% | Streaming entertainment |

| Amazon (NASDAQ:AMZN) | 10% | E-commerce and cloud computing |

| Meta Platforms (NASDAQ:META) | 10% | Digital advertising |

Is Nasdaq a buy : The financial health and growth prospects of NDAQ, demonstrate its potential to underperform the market. It currently has a Growth Score of C. Recent price changes and earnings estimate revisions indicate this would not be a good stock for momentum investors with a Momentum Score of D.