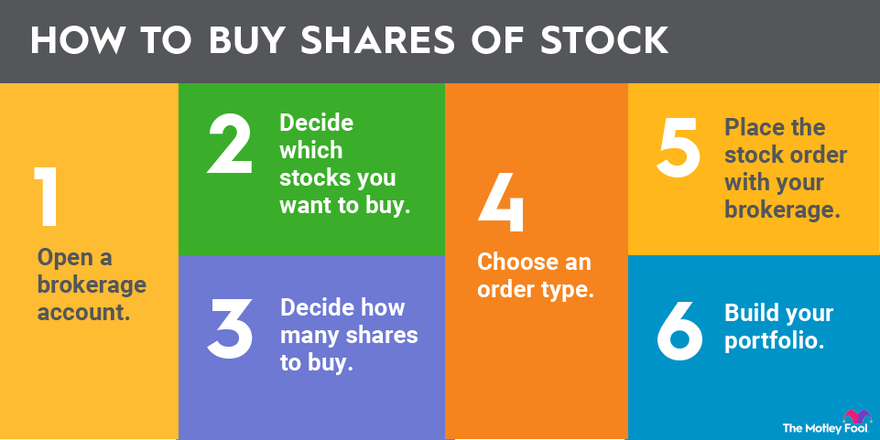

You don't have to have a lot of money to start investing. Many brokerages allow you to open an investing account with $0, and then you just have to purchase stock. Some brokers also offer paper trading, which lets you learn how to buy and sell with stock market simulators before you invest any real money.While there is no minimum order limit on the purchase of a publicly-traded company's stock, many brokers in the past advised buying blocks of stock with a minimum value of $500 to $1,000.So, even if you can only start with $1, do it today. Many brokerage firms allow you to buy fractional shares, which are partial shares of stocks or ETFs, so you really don't have to wait long to start buying investments. Then, your money can start working for you.

What is the minimum amount to put in the stock market : There is no set minimum amount required to begin investing. Individuals can start investing even with a small amount. Moreover, there are some strategies that you can follow to find the right investment amount. The X/3, 100 minus current age and 75% profit strategies are popular.

Can a stock go below $1

When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values. The New York Stock exchange (NYSE), for instance, will remove stocks if the share price remains below one dollar for 30 consecutive days.

Is $5 enough to invest in stocks : But the good news is that most brokerage accounts don't impose a minimum for opening an account, and many allow you to invest on a fractional basis. This means that if you only have $5 to invest with, you can still buy a portion of a share of stock if a full share costs $100 or more.

Investing in the stock market with a small amount of money like $50 or $100 is certainly possible, and it can be a good way to get started with investing.

6 Ways to Turn $1000 into $10000

- Invest in Real Estate.

- Invest in Stocks and ETFs.

- Get Out of Debt Now.

- Start an Online Business.

- Retail Arbitrage.

- Invest in Yourself.

Is 100 shares a lot

A lot is amount of securities bought in a single transaction on an exchange. A round lot is typically 100 shares but investors don't have to buy in round lots. Bunching is the combining of small or unusually-sized trade orders for the same security into one large order for simultaneous execution.The best penny stocks under $1 in May 2024 are:

- Ginkgo Bioworks Holdings Inc. [NYSE: DNA]

- Chicken Soup for the Soul Entertainment Inc. [NASDAQ: CSSE]

- Inno Holdings Inc. [NASDAQ: INHD]

- Collective Audience Inc. [NASDAQ: CAUD]

- Biomerica Inc. [NASDAQ: BMRA]

Can You Start Trading With $100 Yes, you can technically start trading with $100 but it depends on what you are trying to trade and the strategy you are employing. Depending on that, brokerages may ask for a minimum deposit in your account that could be higher than $100.

If a stock falls to or close to zero, it means that the company is effectively bankrupt and has no value to shareholders. “A company typically goes to zero when it becomes bankrupt or is technically insolvent, such as Silicon Valley Bank,” says Darren Sissons, partner and portfolio manager at Campbell, Lee & Ross.

What happens if the S&P 500 goes to zero : A stock price of zero, however, means that the expectation of future earnings is irrevocably lost, as would be the case for a company that dissolves and ceases to do business. In order for an entire stock market to go to zero, the same would need to be true for all companies in the stock market.

Is $100 too little to invest : Investing just $100 a month can actually do a whole lot to help you grow rich over time. In fact, the table below shows how much your $100 monthly investment could turn into over time, assuming you earn a 10% average annual return.

How much is $5 a day for 10 years

Saving $5 per day

By setting aside just $5 per day (or around $150 per month) and investing it at a 6% return, your savings would grow to: After 10 years: $23,725. After 20 years: $66,214. After 30 years: $142,304.

It actually works in your favor to start investing early—even with as little as $50 a month—rather than to wait until you have a few thousand dollars saved up. Although investing involves risk, through time and the power of compounding, your $50-a-month investment can contribute significantly to larger financial goals.How to Make 100 Dollars A Day (Without a Job)

- Launch An Ecommerce Store.

- Become A Freelancer.

- Create and Sell Online Courses.

- Become An Influencer.

- Become An Uber/Lyft Driver.

- Online Tutoring.

- Become An Airbnb Host.

- Pet Sitting.

How can I double $10,000 dollars : There are so many ways to turn $10,000 into more money, including:

- Investing in real estate with companies like RealtyMogul or Fundrise.

- Investing in stocks and ETFs.

- Starting an online business or side hustle.

- Investing in cryptocurrency.

:max_bytes(150000):strip_icc()/Shorterminvestments_final-47c4f8852ab945b0b940c79d8efdc3bc.png)

:max_bytes(150000):strip_icc()/Term-p-penny-stock-resized-95f3b55da68e42d18446fbabefb7164c.jpg)