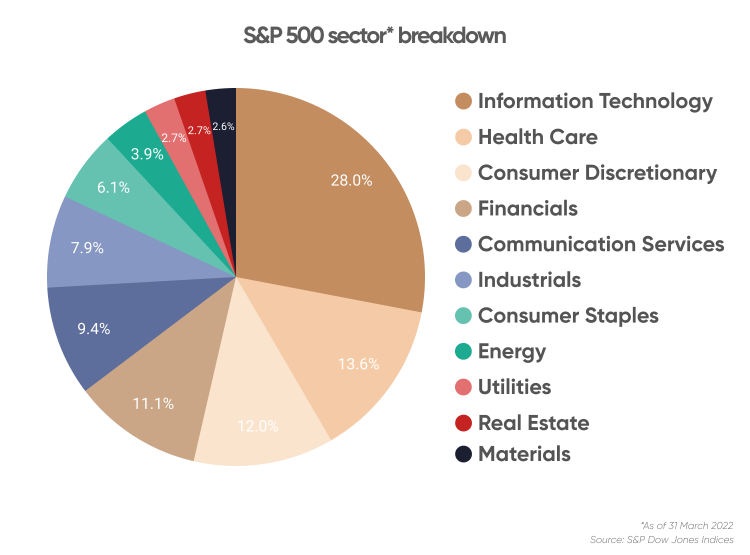

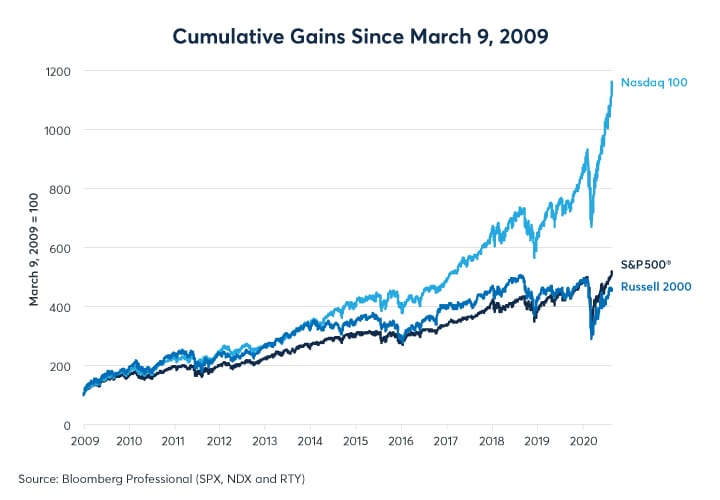

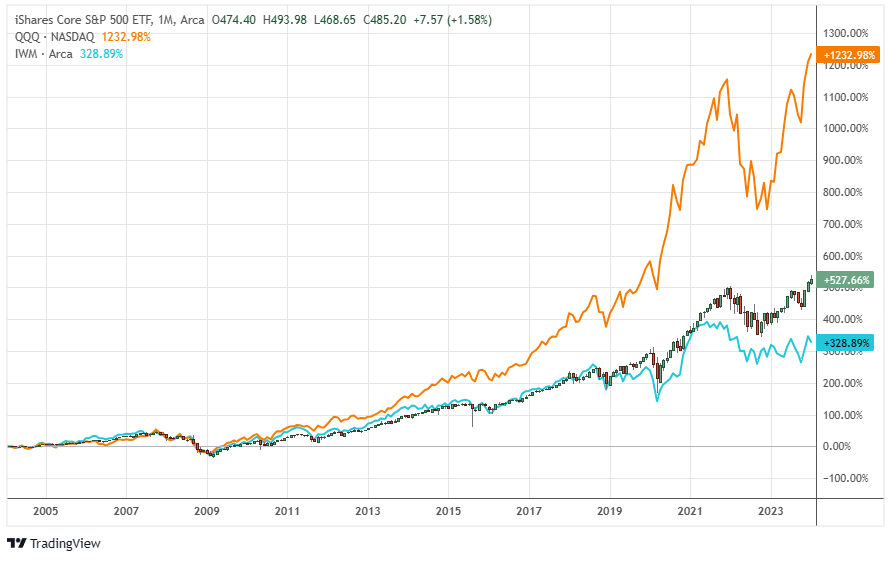

So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Is the S&P 500 a good investment : The S&P 500 has generated an annualized total return of 16% over the past five years, compared with a 30-year annual average of 10%. The top 10 stocks have accounted for more than a third of that gain.

Is it a good idea to invest in S and P

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

Is Nasdaq or S&P more volatile : Rolling Volatility (One Year)

The one-year rolling volatility, calculated by annualizing the standard deviation of daily returns, has shown a slight elevation in the Nasdaq-100 compared to the S&P 500. On average, it has been just 2.6% higher over the period spanning from December 31, 2007, to September 30, 2023.

The Nasdaq is another kind of scoreboard that looks at tech companies, and it has a lot more companies than the Dow. The S&P 500 includes 500 large companies and gives a broader look at the stock market. Understanding these indices is important for those interested in investing in US stocks.

Vanguard S&P 500 ETF

ETFs are convenient and effective, to say the least. If you're interested in investing in an ETF and have $1,000 that you can spare to invest — meaning you already have an emergency fund saved and have paid down any high-interest debt — the Vanguard S&P 500 ETF (VOO 0.04%) is a great option.

Which is better Dow Nasdaq or S&P 500

The S&P 500 is considered a better reflection of the market's performance across all sectors compared to the Nasdaq Composite and the Dow. The downside to having more sectors included in the index is that the S&P 500 tends to be more volatile than the Dow.The Dow represents only a narrow slice of the economy. Professional investors tend to look at broader measures of the market, such as the S&P 500 index, which has nearly 17 times the number of companies within it.Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

The S&P 500 carries market risk, as its value fluctuates with overall market performance, as well as the performance of heavily weighted stocks and sectors. For example, the technology sector performed poorly in 2022 and was a large contributor to the index's correction that year.

Is S&P 500 too risky : Choosing your investments

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky.

Why does Nasdaq outperform S&P : The Nasdaq-100 is heavily allocated towards top-performing industries such as Technology, Consumer Discretionary, and Health Care, which have helped the Nasdaq-100 outperform the S&P 500 by a wide margin between December 31, 2007, and March 31, 2023.

Is Nasdaq the same as S&P

The Bottom Line. The S&P 500, the Dow, and the Nasdaq Composite are different indexes used to track market performance. Even though they have different pedigrees, inclusion criteria, and sectoral composition, the indexes generally move in the same direction.

Nasdaq has a decent track record of beating estimates in the last three reported quarters of 2023. Return on equity was 21.6% in the trailing 12 months, better than the industry average of 12.4%. Return on invested capital hovered around 10% over the last few years.The Nasdaq-100 is quite different than the S&P 500

But all of the largest companies in the Nasdaq-100 are also included in the S&P 500 index, including Apple, Microsoft, Amazon, Alphabet, Facebook, and (now) Tesla.

How much is $1000 a month for 5 years : In fact, at the end of the five years, if you invest $1,000 per month you would have $83,156.62 in your investment account, according to the SIP calculator (assuming a yearly rate of return of 11.97% and quarterly compounding).