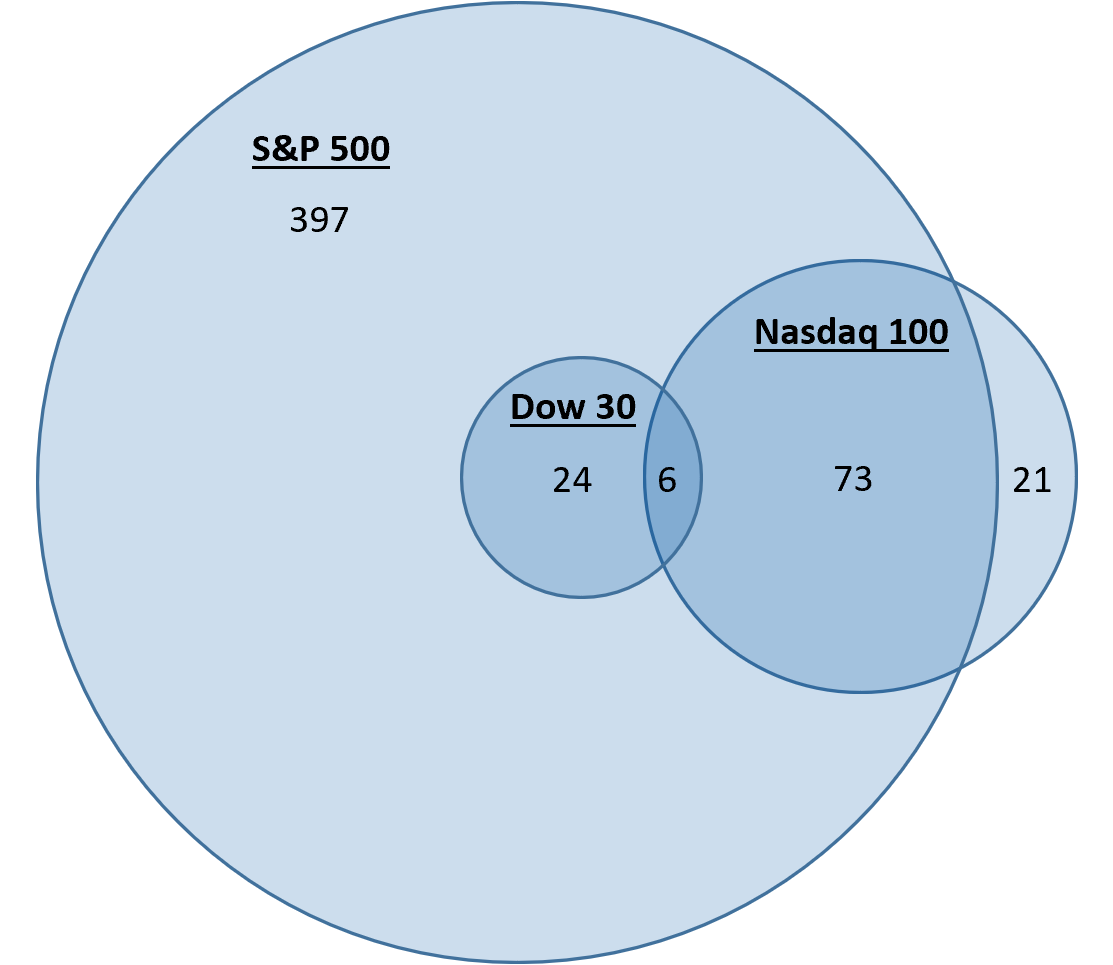

The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE).Open an investment account: Select a reputable brokerage platform that offers access to the S&P 500. Companies such as Schwab, Fidelity or Vanguard offer their own proprietary S&P 500 index funds, as do many others. Create an account, complete the necessary paperwork and fund your account to begin investing.The S&P 500 index, or Standard & Poor's 500, is a very important index that tracks the performance of the stocks of 500 large-cap companies in the U.S. The ticker symbol for the S&P 500 index is ^GSPC. The series of letters represents the performance of the 500 stocks listed on the S&P.

Is US500 the same as S&P 500 : The US500 (S&P 500) is a market capitalization weighted index of the 500 largest publically traded companies in the U.S. It is also float adjusted, meaning the weight of each individual company is determined by a combination of market capitalization and the number of shares outstanding.

Is S&P 500 only US stocks

The S&P 500 (also known as the Standard & Poor's 500) is a registered trademark of the joint venture S&P Dow Jones Indices. It is a stock index that consists of the 500 largest companies in the U.S. and is generally considered the best indicator of how U.S. stocks are performing overall.

How many NYSE stocks are in the S&P 500 : 503 stocks

The S&P 500 consists of 500 companies that have issued a total of 503 stocks.

Investing in the S&P 500

Most major brokerages and investing platforms offer the opportunity to invest in an S&P 500 index fund, including Public. SPDR S&P 500 ETF Trust (SPY), Vanguard S&P 500 ETF (VOO), and iShares Core S&P 500 ETF (IVV) are just a few examples of S&P 500 funds available for investors.

If you're buying a stock index fund or almost any broadly diversified stock fund such as one based on the S&P 500, it can be a good time to buy if you're prepared to hold it for the long term. That's because the market tends to rise over time, as the economy grows and corporate profits increase.

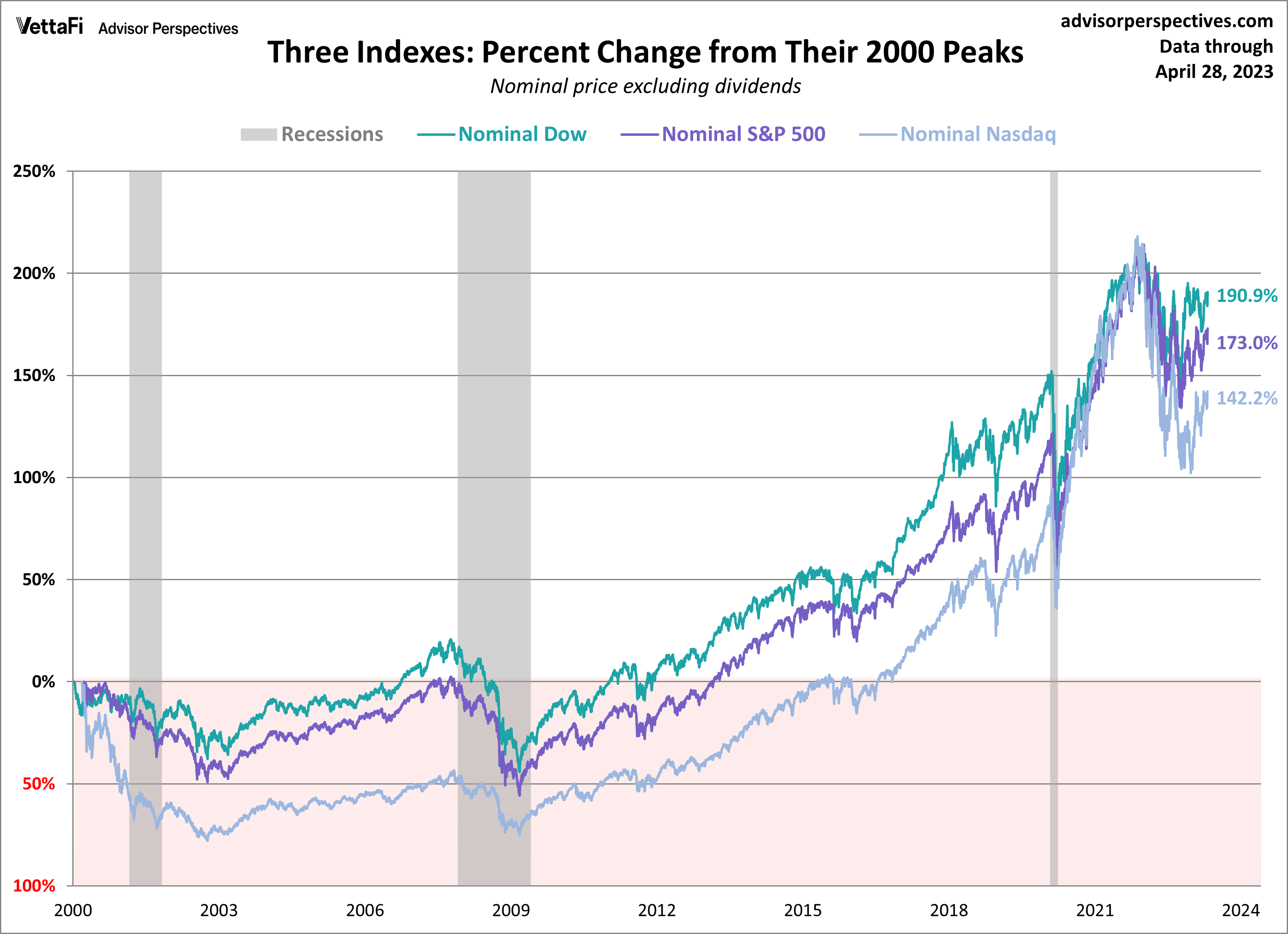

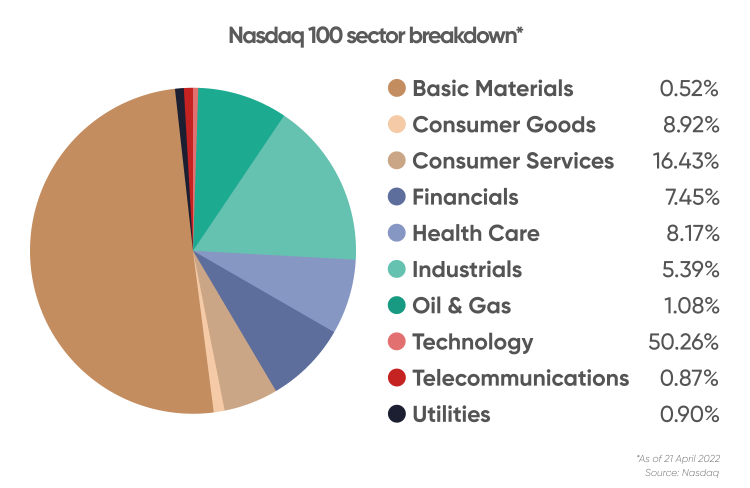

What is the difference between the Nasdaq and the S&P 500

The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization. Other indexes, like the Wilshire 5000 and Russell 2000, cover broader market segments.Nasdaq was initially an acronym, NASDAQ, which stands for the National Association of Securities Dealers Automated Quotations. It opened on Feb. 8, 1971, providing automated information about stock prices that investors could use to trade stocks on other exchanges.The Nasdaq US 500 Large Cap Index (NQUS500LC) consists of the largest 500 stocks ranked by float-adjusted market capitalizations and assigned to the country of the United States according to the Nasdaq Global Index Family Methodology.

The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization. Other indexes, like the Wilshire 5000 and Russell 2000, cover broader market segments.

Should I buy Nasdaq or S&P 500 : So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

What is the difference between the Nasdaq and the sp500 : The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization. Other indexes, like the Wilshire 5000 and Russell 2000, cover broader market segments.

Is S&P 500 only American companies

All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding.

S&P Global

McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

How much money was $1000 invested in the S&P 500 in 1980 : In 1980, had you invested a mere $1,000 in what went on to become the top-performing stock of S&P 500 (^GSPC -0.21%), then you would be sitting on a cool $1.2 million today. That equates to a total return of 120,936%.