:max_bytes(150000):strip_icc()/SP-500-Index-d04148d29bca4307b412f4fd91741e17.jpg)

What Is the S&P 500 Index The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.Criteria for Inclusion in the S&P 500

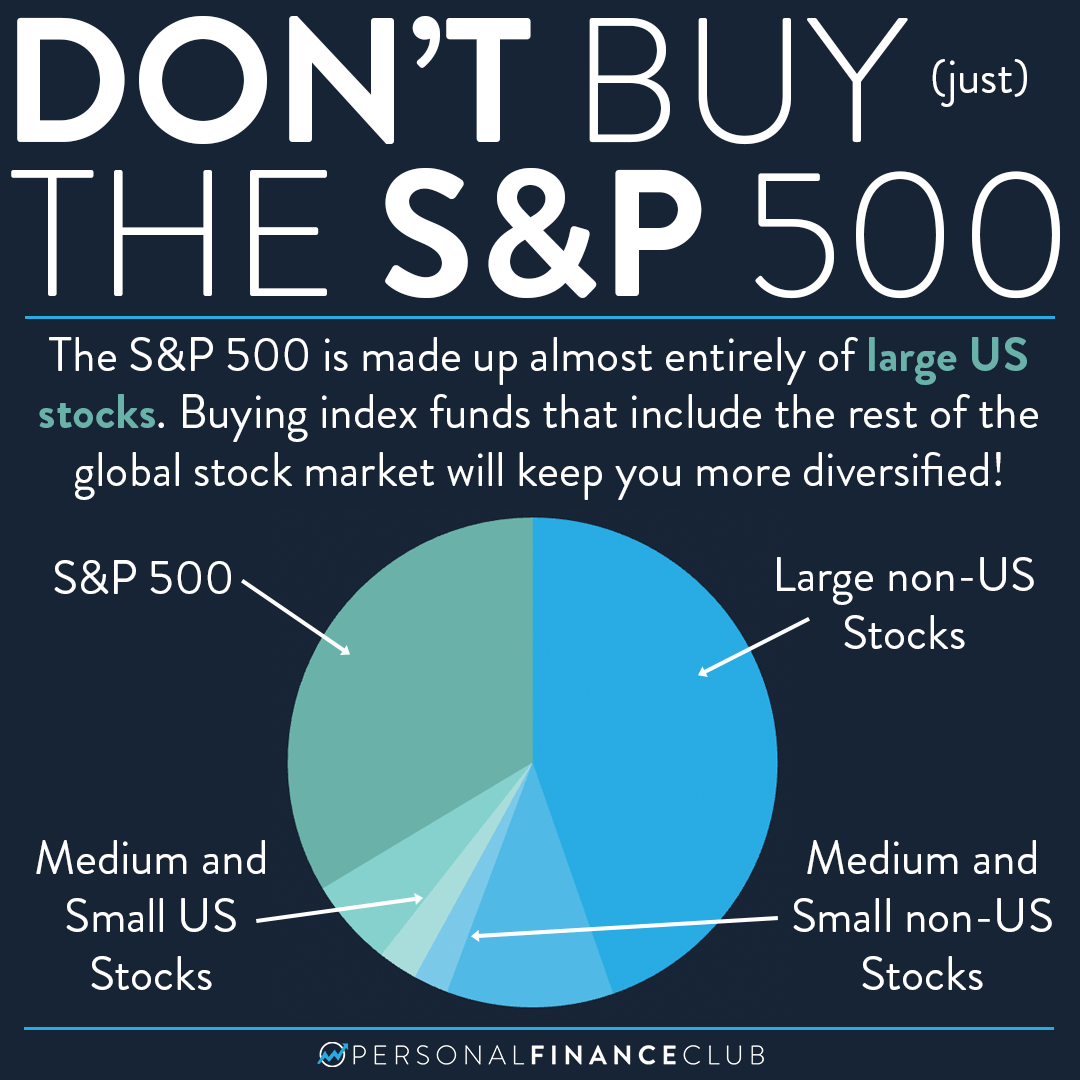

Its shares must be highly liquid. At least 50% of its outstanding shares must be available for public trading. It must report positive earnings in the most recent quarter. The sum of its earnings in the previous four quarters must be positive.Can I invest in the S&P 500 from the UK Yes, you can invest in the S&P 500 but you can't invest directly in the index. However, you can buy stocks and shares in the companies listed in the S&P 500. Another way to invest in an index is to buy index mutual funds or index ETFs that track the performance of the S&P 500.

What does s & p stand for : Standard & Poor’s

Standard & Poor's (S&P) is a leading index provider and data source of independent credit ratings. The McGraw-Hill Cos. purchased S&P in 1966, and in 2016, the company became known as S&P Global.

Can foreign companies be on the S&P 500

To be eligible for inclusion in the S&P 500, a company must: Be based in the U.S., with a significant share of its fixed assets and revenues in the U.S. However, some companies domiciled in overseas tax jurisdictions are considered American for listing purposes.

Which country is S&P from : American

S&P Global Inc.

(prior to April 2016 McGraw Hill Financial, Inc., and prior to 2013 The McGraw–Hill Companies, Inc.) is an American publicly traded corporation headquartered in Manhattan, New York City.

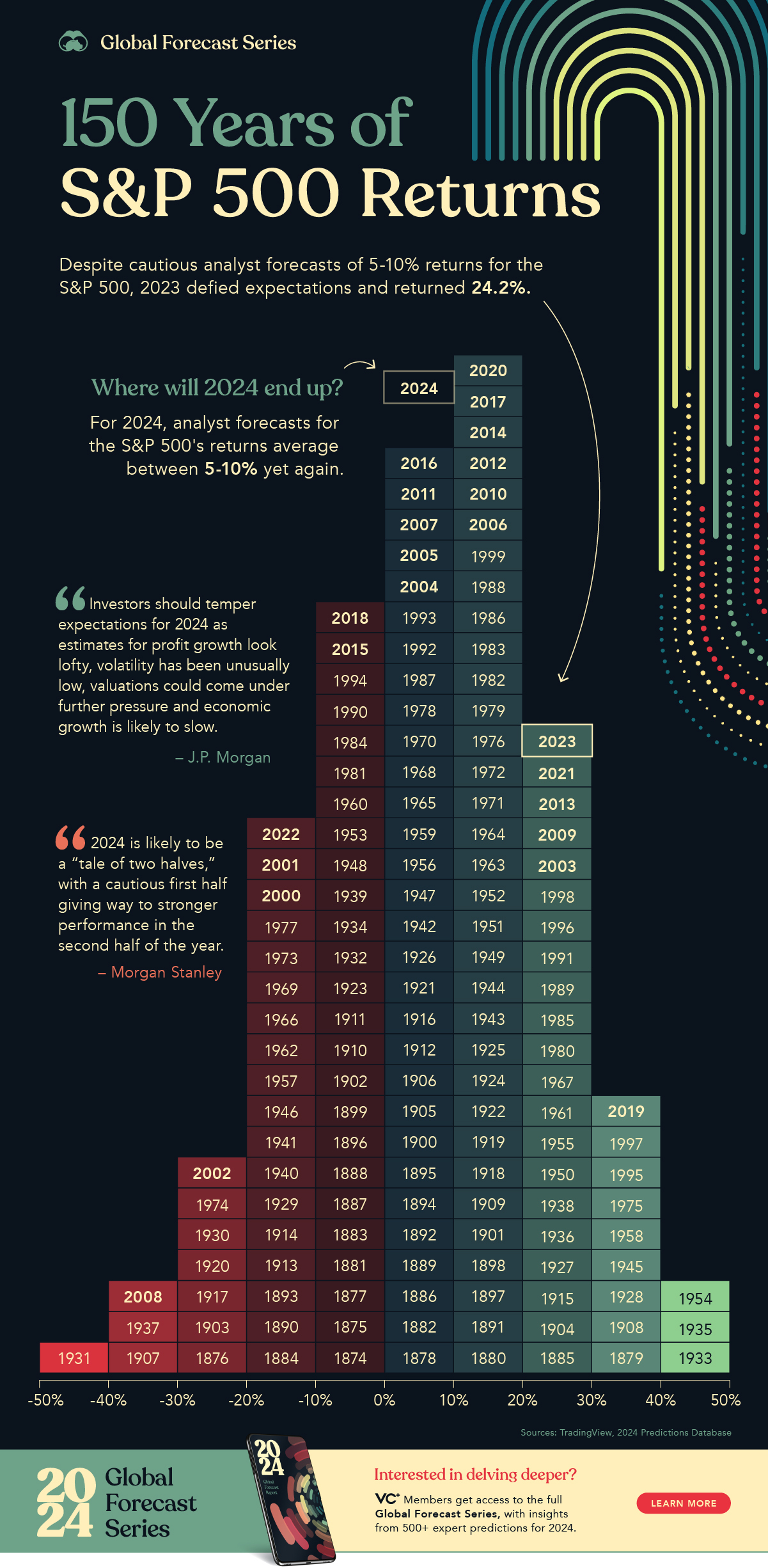

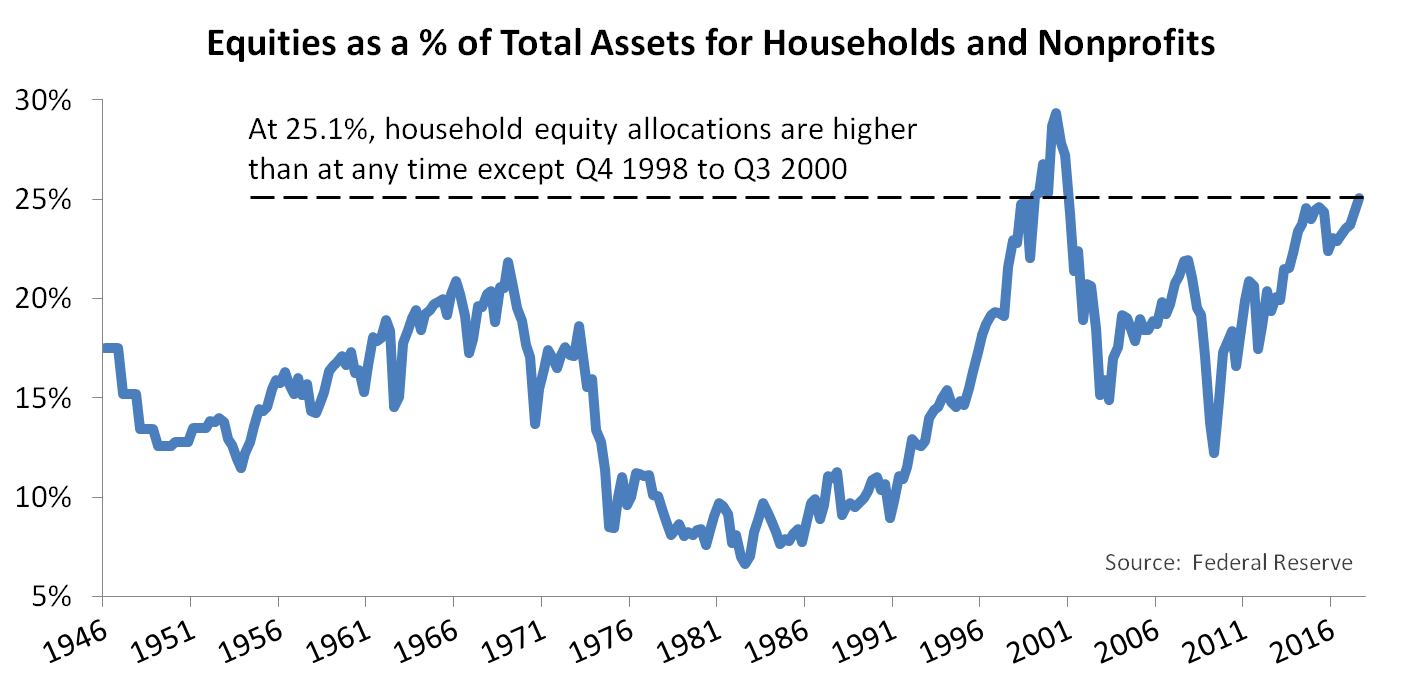

There are never any guarantees when investing, but an S&P 500 index fund is about as close as you can get to guaranteed positive long-term returns. In fact, analysts at Crestmont Research examined the S&P 500's rolling 20-year total returns to find out how many of those periods resulted in positive total gains.

If you're buying a stock index fund or almost any broadly diversified stock fund such as one based on the S&P 500, it can be a good time to buy if you're prepared to hold it for the long term. That's because the market tends to rise over time, as the economy grows and corporate profits increase.

Where to buy S and P 500 stock

| Compare the Best Online Brokers | ||

|---|---|---|

| Company | Category | Account Minimum |

| Fidelity Investments | Best Overall, Best for Low Costs, Best for ETFs | $0 |

| TD Ameritrade | Best for Beginners and Best Mobile App | $0 |

| Tastyworks | Best for Options | $0 |

Launched on July 2, 2012, S&P Dow Jones Indices is the world's largest global resource for index-based concepts, data, and research.In terms of sector diversification, the S&P Global 100 Index has a broader sector mix than that of the S&P 500. The top 10 holdings span across not just I.T. but also Consumer Discretionary, Energy, Health Care, Consumer Staples, and Financials, as of 30 June 2022.

The VUSA ETF is a European version of the S&P 500 index, offering investors in Europe an easy way to access the U.S. stock market. It is managed by Vanguard, a well-respected global asset manager with a long track record of managing low-cost index-tracking funds.

Can Europeans buy S&P 500 : As an investor, we cannot invest directly in the S&P500 index. Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs). An ETF is an instrument that mirrors the performance of an underlying index. Similar to stocks, ETFs are also traded in the stock market.

How many countries is S&P in : With over 70 offices in 35 countries, we gather intelligence in every corner of the globe, to deliver the credit ratings, assessments and analyses that governments, companies and individuals depend on all over the world.

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

In 1980, had you invested a mere $1,000 in what went on to become the top-performing stock of S&P 500 (^GSPC -0.21%), then you would be sitting on a cool $1.2 million today. That equates to a total return of 120,936%.He holds nearly 40,000 shares of the SPDR S&P 500 ETF Trust (NYSE:SPY), valued at approximately $18.73 million. He has also maintained a stake in the Vanguard S&P 500 ETF (NYSE:VOO), holding 43,000 shares valued at $18.78 million.

Is the S and P 500 still a good investment : But if researching and staying up to date on individual companies and their stocks isn't for you, you can still earn great returns by investing in a simple, broad-based index fund like the Vanguard S&P 500 ETF (VOO 0.19%).