The sweet spot, according to experts, seems to be 15% of your pretax income. Matt Rogers, a CFP and director of financial planning at eMoney Advisor, refers to the 50/15/5 rule as a guideline for how much you should be continuously investing.Risk of Higher Losses

While margin traders can make higher profits, they can also incur larger losses. It is even possible for a margin trader to lose more money than they originally had to invest—meaning that they would have to make up the difference with additional assets.Rest easy knowing the cash in your Vanguard Cash Plus bank sweep is eligible for FDIC coverage up to $1.25 million for individual accounts and $2.5 million for joint accounts. You can keep all your money in the bank sweep or diversify into 5 available Vanguard money market funds (each with a $3,000 minimum investment).

How safe are money market funds : How safe are money market funds There is little risk associated with money market funds. The U.S. Securities and Exchange Commission (SEC) mandates that only the highest-credit-rated securities are available in money market funds.

How much is too much in a brokerage account

Since you can expect a good return over time if you make informed choices, you can't really have too much money in your brokerage account. After all, you want as much money as possible earning the highest possible returns. This is different from, say, keeping your money in a high-yield savings account.

How much cash should I leave in my brokerage account : At the least, you should have enough cash to keep your emergency fund fully flush. That means enough cash to cover expenses for six moths, should you need it. Many investors keep as much as 20% to 30% of their portfolios in cash.

While margin loans can be useful and convenient, they are by no means risk free. Margin borrowing comes with all the hazards that accompany any type of debt — including interest payments and reduced flexibility for future income. The primary dangers of trading on margin are leverage risk and margin call risk.

Investors can potentially lose money faster with margin loans than when investing with cash. This is why margin investing is usually best restricted to professionals such as managers of mutual funds and hedge funds.

Is Vanguard financially stable

About Vanguard

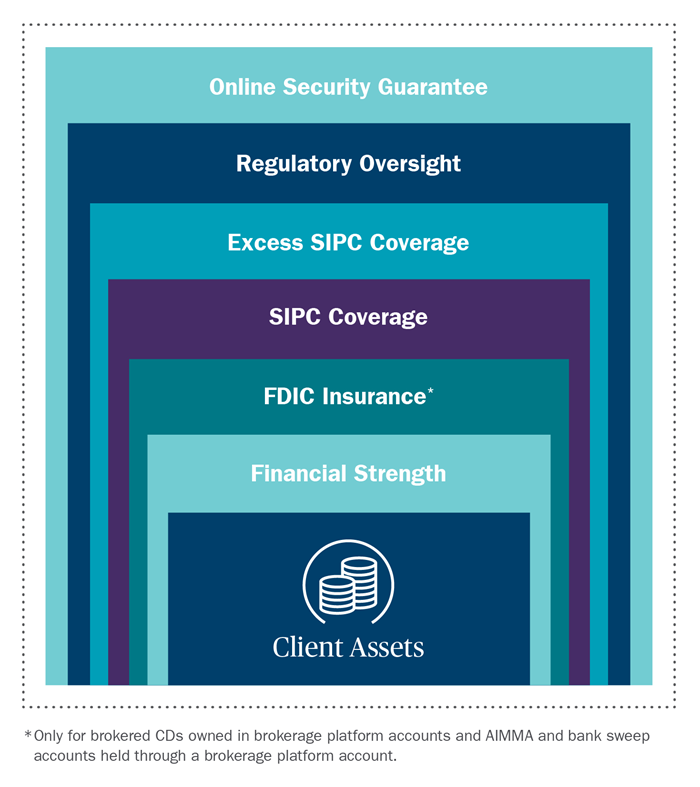

Vanguard's mission is to "take a stand for all investors, to treat them fairly, and to give them the best chance for investment success."6 It prides itself on its stability, transparency, low costs, and risk management.Long-term investors will appreciate Vanguard's low fees. With zero-commission brokerages, continuous coverage of trendy stocks like Tesla Inc. (ticker: TSLA) and the extreme fluctuations of meme stocks like GameStop Corp. (GME), it's easy to overlook the benefits of a buy-and-hold strategy.While bank balances are insured by the FDIC, investments in a brokerage account are covered by the Securities Investor Protection Corporation (SIPC). It protects investors in the unlikely event that their brokerage firm fails. However, certain rules and conditions apply—and investment earnings are not insured.

There is no direct way to lose money in a money market account. However, it is possible to lose money indirectly. For example, if the interest rate you receive on your account balance can no longer keep up with any penalty fees you may be assessed, the value of the account can fall below the initial deposit.

How long will $500,000 last in retirement : According to the 4% rule, if you retire with $500,000 in assets, you should be able to withdraw $20,000 per year for 30 years or more. Moreover, investing this money in an annuity could provide a guaranteed annual income of $24,688 for those retiring at 55.

How risky is a brokerage account : They Involve Risk

(FDIC) or National Credit Union Association (NCUA), your money is guaranteed up to $250,000 per person, per financial institution. The SIPC insures member brokerage accounts if your brokerage fails, but it doesn't protect against losses if your investments decline in value.

Can I keep money in a brokerage account

You probably wouldn't dream of leaving piles of cash lying around your home. But many investors end up doing this with cash in their brokerage accounts. Uninvested cash is a potentially valuable part of your investment portfolio. So it pays to pay attention to it, especially when interest rates move up or down.

Savings accounts and brokerage accounts serve very different purposes. Savings accounts are a safe place for your money, but your money won't earn the kind of return it might in an investment account. If the money is to be used at least several years in the future, it's likely better to invest it.You can lose more than all of your money on margin. For example, if you made a trade by borrowing 50% on margin, half of the trade is funded with borrowed capital.

How much margin is safe : A modest 10% to 20% leverage rate is not dangerous for most people, even factoring in that maintenance requirement can rise during times of peak volatility.