Some index funds provide exposure to thousands of securities in a single fund, which helps lower your overall risk through broad diversification. By investing in several index funds tracking different indexes you can built a portfolio that matches your desired asset allocation.You should therefore only keep as many funds in your portfolio as you're comfortable monitoring. For example, if you hold 10 or 20 different funds, you'll need to keep a close eye on the changing value of all these investments to make sure your asset allocation still matches your investment goals.The addition of too many funds simply creates an expensive index fund. This notion is based on the fact that having too many funds negates the impact that any single fund can have on performance, while the expense ratios of multiple funds generally add up to a number that is greater than average.

Is it OK to invest all money in one mutual fund : Over-Diversification of Mutual Funds

If you invest too much in one company's stock, you are at great risk. If something happens to that company, a significant portion of your money could get wiped away.

Is it OK to just buy one ETF

The one time it's okay to choose a single investment

You wouldn't ever want to load up your portfolio with a single stock. But if you're buying S&P 500 ETFs, this is the one scenario where you might get away with only owning a single investment. That's because your investment gives you access to the broad stock market.

Do billionaires invest in index funds : It's easy to see why S&P 500 index funds are so popular with the billionaire investor class. The S&P 500 has a long history of delivering strong returns, averaging 9% annually over 150 years. In other words, it's hard to find an investment with a better track record than the U.S. stock market.

Diversification is an important investment strategy that can help reduce overall risk and increase potential returns. Investing in multiple index funds allows investors to spread their money across different asset classes, sectors, and geographies.

The 4% rule says people should withdraw 4% of their retirement funds in the first year after retiring and take that dollar amount, adjusted for inflation, every year after. The rule seeks to establish a steady and safe income stream that will meet a retiree's current and future financial needs.

Is 12 ETFs too many

Experts agree that for most personal investors, a portfolio comprising 5 to 10 ETFs is perfect in terms of diversification. But the number of ETFs is not what you should be looking at.As mentioned above, the amount of funds you hold is dependent on the funds you are comfortable monitoring in your portfolio. Some investors may prefer to hold several funds, for others, holding one fund may be easier to manage. There are a number of tools on our website that can help you choose a fund.Mutual funds are largely a safe investment, seen as being a good way for investors to diversify with minimal risk. But there are circumstances in which a mutual fund is not a good choice for a market participant, especially when it comes to fees.

Meanwhile, if you only invest in S&P 500 ETFs, you won't beat the broad market. Rather, you can expect your portfolio's performance to be in line with that of the broad market. But that's not necessarily a bad thing. See, over the past 50 years, the S&P 500 has delivered an average annual 10% return.

Is 2 ETFs enough : Experts agree that for most personal investors, a portfolio comprising 5 to 10 ETFs is perfect in terms of diversification.

Does Warren Buffett believe in index funds : Though Buffett's investment prowess has often been associated with his adept stock-picking skills, his persistent advocacy for index funds sheds light on a simple yet powerful strategy for investors.

Can I beat the S&P 500

Beating the S&P 500 consistently is no easy task, and most funds fail. One ETF that is focused on growth and value has achieved this feat. This fund also trades at a cheaper valuation than the S&P 500 right now.

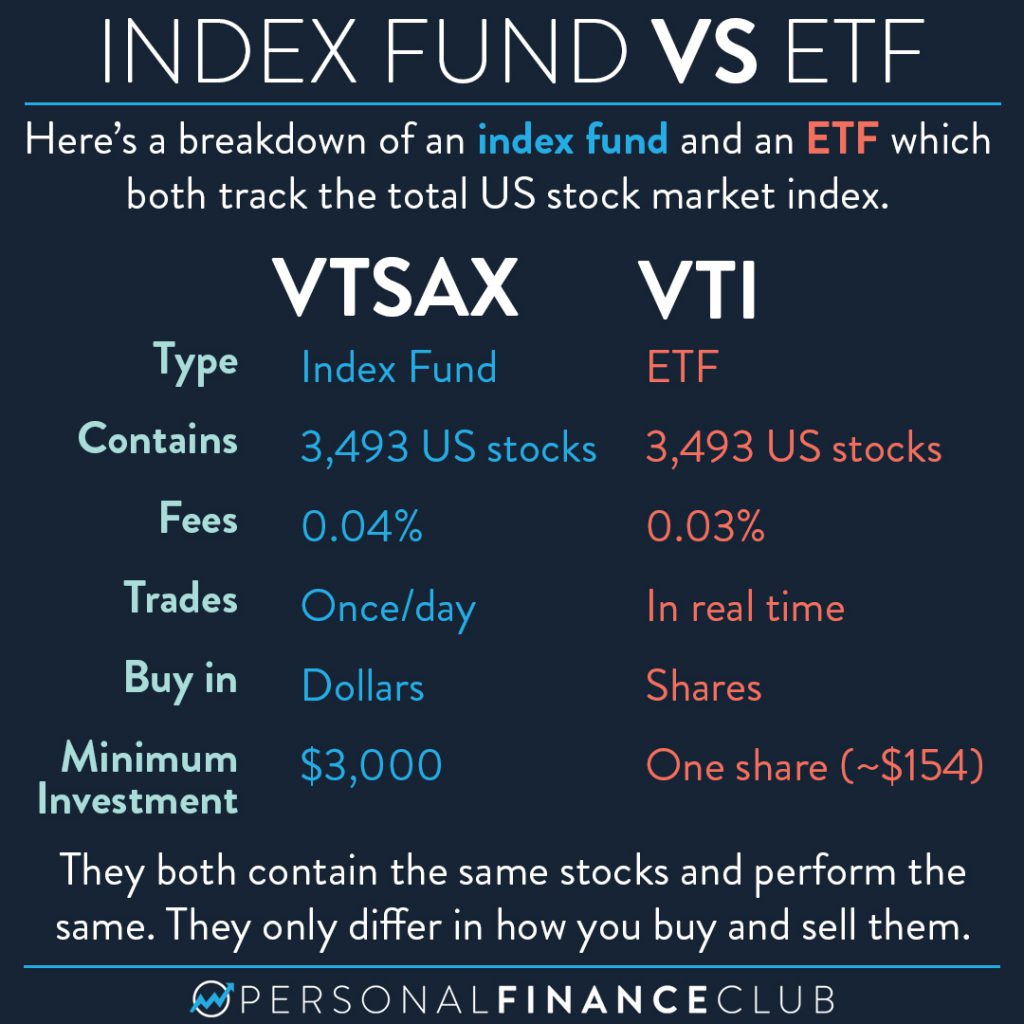

How long has it historically taken a stock investment to double NYU business professor Aswath Damodaran has done the math. According to his math, since 1949 S&P 500 investments have doubled ten times, or an average of about seven years each time.S&P 500 index funds will be nearly identical to one another in terms of their performance and their holdings, or the particular stocks held within the fund. Investing in multiple S&P 500 index funds will not necessarily further diversify your portfolio.

Is 1 ETF enough : Generally speaking, fewer than 10 ETFs are likely enough to diversify your portfolio, but this will vary depending on your financial goals, ranging from retirement savings to income generation.