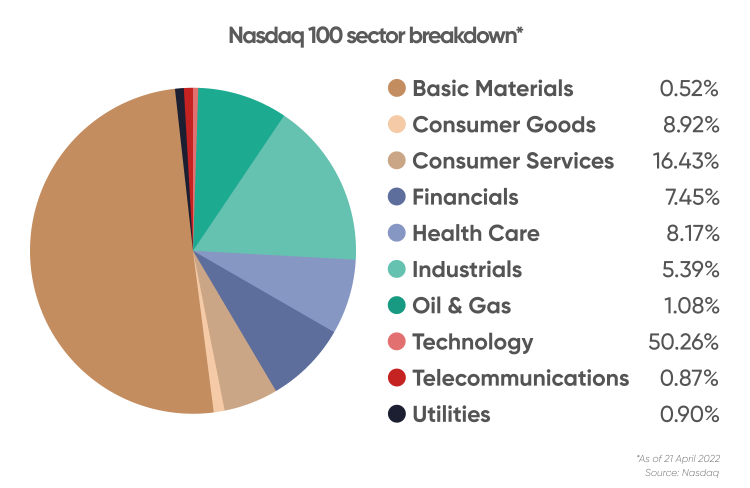

The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%. You could have earned a maximum 10-year CAGR return of 21% by investing in Nasdaq 100, while in the case of S&P 500, you could have earned a maximum return of 14% in the past 15 years.The S&P 500 index can be traded indirectly by using mutual funds or ETFs made up of stocks or futures, or it can be traded via Contracts for Difference (CFDs). Traders could choose to mimic S&P 500 trading by purchasing stocks or futures from each of the 500 companies."In my view, for most people, the best thing to do is own the S&P 500 index fund," Buffett had once said. "The trick is not to pick the right company. The trick is to essentially buy all the big companies through the S&P 500 and to do it consistently and to do it in a very, very low-cost way," he further added.

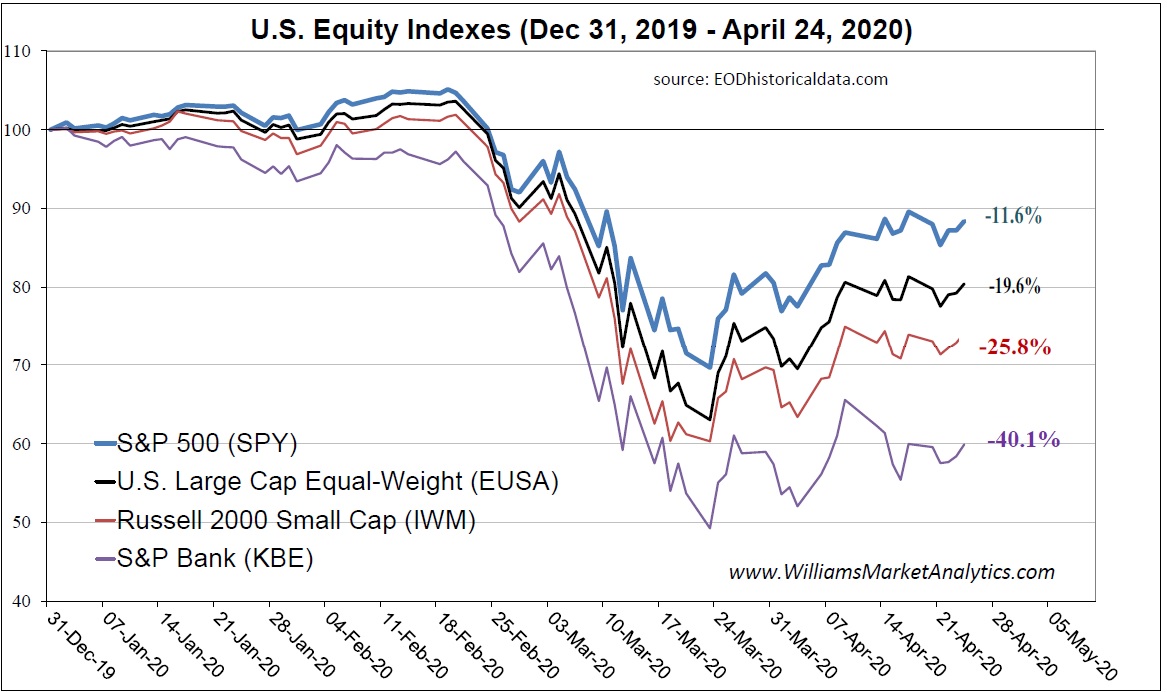

Why is the S&P 500 better than the Nasdaq : The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization. Other indexes, like the Wilshire 5000 and Russell 2000, cover broader market segments.

Is the S and P 500 a good investment

Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

How much dividends from s and p 500 : Does the S&P 500 Pay Dividends The S&P 500 is an index, so it does not pay dividends; however, there are mutual funds and exchange-traded funds (ETFs) that track the index, which you can invest in. If the companies in these funds pay dividends, you'll receive yours based on how many shares of the funds you hold.

A 70/30 portfolio is an investment portfolio where 70% of investment capital is allocated to stocks and 30% to fixed-income securities, primarily bonds. Any portfolio can be broken down into different percentages this way, such as 80/20 or 60/40.

Buffett is also uninterested in gold. In his 2011 letter to shareholders, he noted that gold has two significant shortcomings, “being neither of much use nor procreative.” “If you own one ounce of gold for an eternity, you will still own one ounce at its end.

Is buying the S and P 500 a good investment

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)The S&P 500 weighting system gives a small number of companies major influence, which could have an undue negative effect on the index if one or a few of them run into trouble. The index does not expose investors to small or emerging companies with the potential for market-beating growth.Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Is now a good time to buy index funds If you're buying a stock index fund or almost any broadly diversified stock fund such as one based on the S&P 500, it can be a good time to buy if you're prepared to hold it for the long term.

Is S and P 500 good investment : Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

What is Warren Buffett’s 90/10 rule : Warren Buffet's 2013 letter explains the 90/10 rule—put 90% of assets in S&P 500 index funds and the other 10% in short-term government bonds.

Are 90% stocks and 10% bonds good

A 90/10 investment allocation is an aggressive strategy most suitable for investors with a high risk tolerance and a long time horizon. While Warren Buffett has an enviable track record as an investor, it probably isn't for everyone. Berkshire Hathaway Inc.

"Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1."- Warren Buffet.Stock market forecast for the next decade

| Year | Price |

|---|---|

| 2027 | 6200 |

| 2028 | 6725 |

| 2029 | 7300 |

| 2030 | 8900 |

Is S&P 500 too risky : Choosing your investments

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky.

:max_bytes(150000):strip_icc()/GettyImages-496030068-29ec863cca36413ab111277d250fe964.jpg)