The estimates from strategists put the median target for the S&P 500 at 5,200 by the end of 2024, implying a decline of less than 1% from Friday's level, according to MarketWatch calculations. Heading into 2024, the median target was around 5,000 (see table below).The S&P 500 could hit 10,000 by the mid-2030s. In the following pages we present our analysis, which draws on four key observations: • The historical pattern of market returns suggests strong future returns. Equity valuation is attractive relative to other assets.The high-water mark for stock projections in 2024 has once again moved up. In a note to clients on Monday, Wells Fargo's head of equity strategy, Christopher Harvey, boosted his year-end target for the S&P 500 (^GSPC) to 5,535 from 4,625.

How much will the S&P 500 be worth in 2025 : Despite recent pullbacks, the S&P 500's performance has remained in the green since the start of 2024, extending its last year's rally fueled by a resilient US economy, expectations of rate cuts, and unprecedented expansion in the AI sector.

How much will S&P be worth in 10 years

Stock market forecast for the next decade

| Year | Price |

|---|---|

| 2027 | 6200 |

| 2028 | 6725 |

| 2029 | 7300 |

| 2030 | 8900 |

Is S and P 500 a good investment : Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

In terms of a price target, Bank of America is targeting S&P 500 5,150 to 8,700 with its S&P 500 price forecast for 2030.

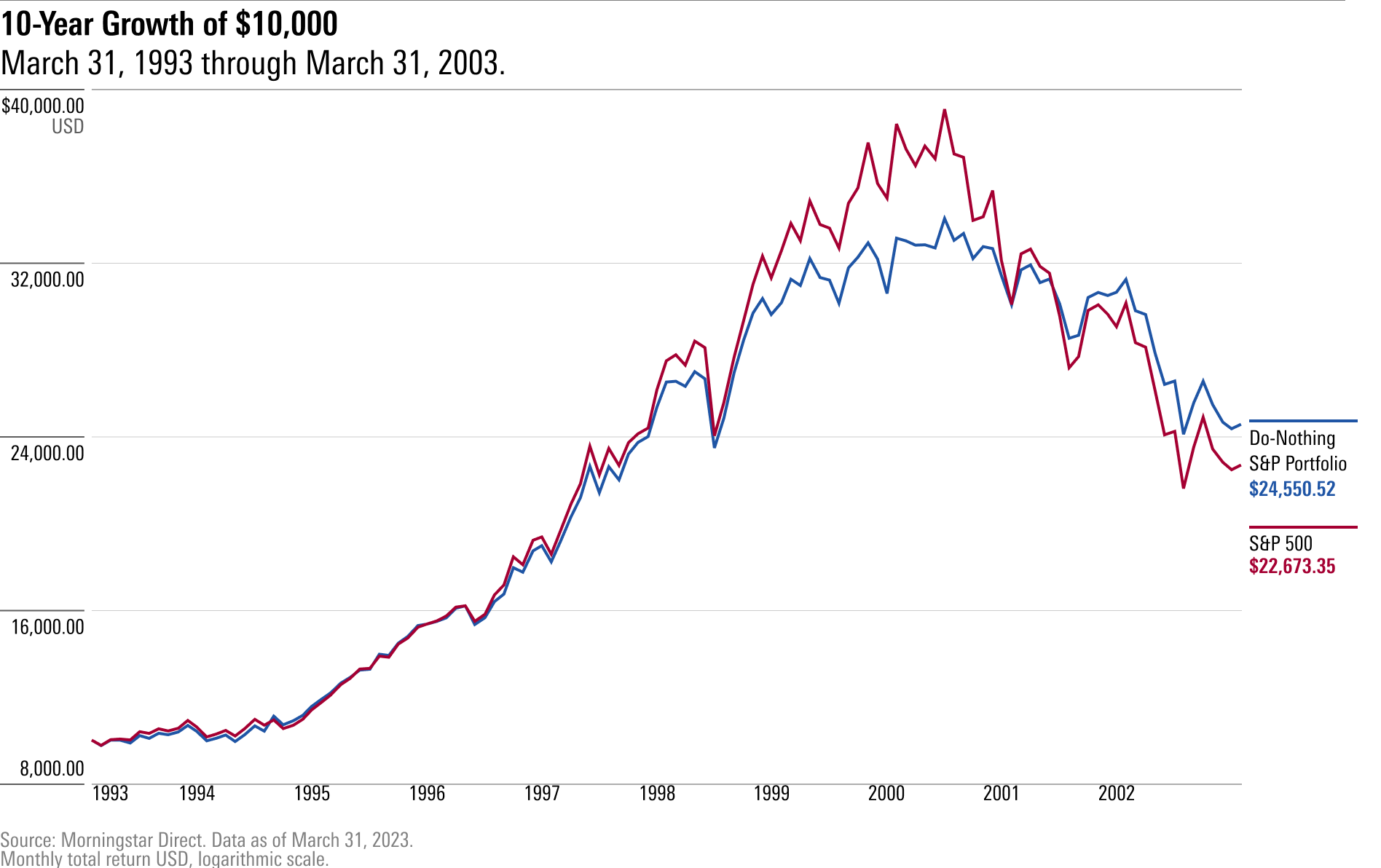

Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.

How much will the S&P 500 be worth in 2030

Stock market forecast for the next decade

| Year | Price |

|---|---|

| 2027 | 6200 |

| 2028 | 6725 |

| 2029 | 7300 |

| 2030 | 8900 |

Stock market forecast for the next decade

| Year | Price |

|---|---|

| 2027 | 6200 |

| 2028 | 6725 |

| 2029 | 7300 |

| 2030 | 8900 |

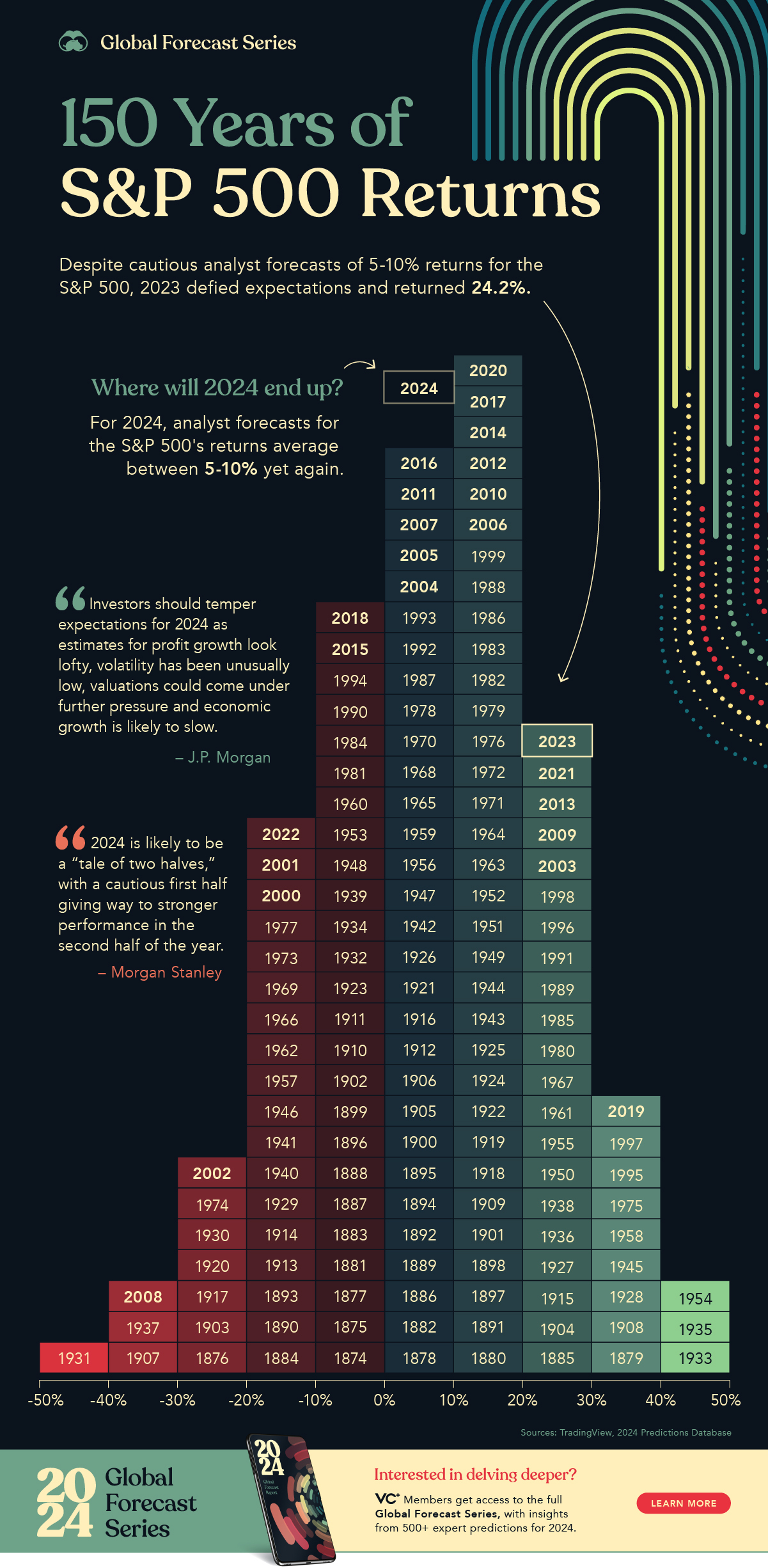

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

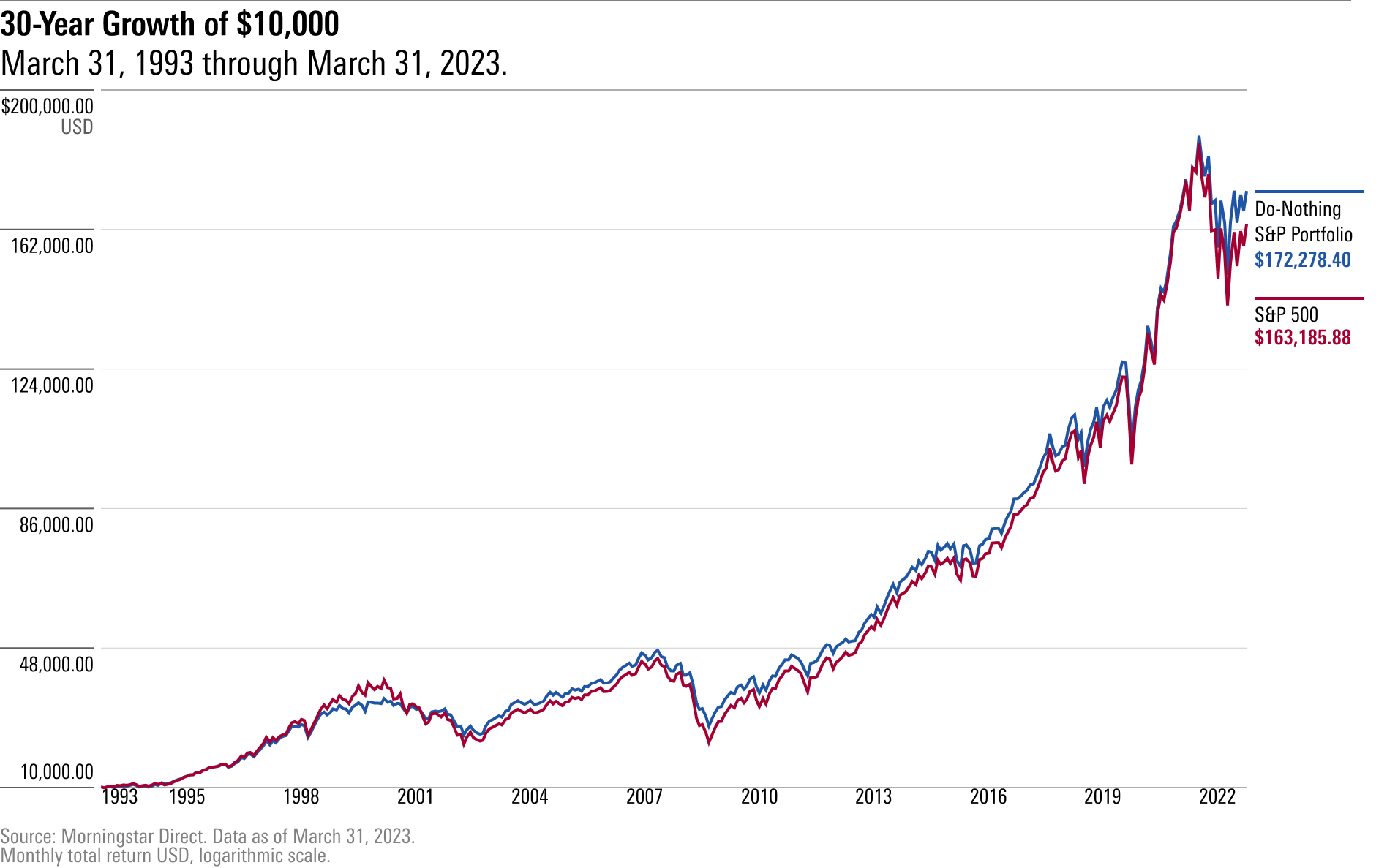

If you take your $100,000 and put it in an S&P 500 index fund, you could end up with over $1 million within 24 years if the index produces returns in line with its historical average. If you keep saving, you can get there even faster.

What is the S&P 500 over 20 years : The historical average yearly return of the S&P 500 is 9.88% over the last 20 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 20-year average stock market return (including dividends) is 7.13%.

Should I invest in the S&P 500 now : Is now a good time to buy index funds If you're buying a stock index fund or almost any broadly diversified stock fund such as one based on the S&P 500, it can be a good time to buy if you're prepared to hold it for the long term.

What is the 20 year return of the S&P 500

The historical average yearly return of the S&P 500 is 9.88% over the last 20 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 20-year average stock market return (including dividends) is 7.13%.

Ed Yardeni of Yardeni Research told CNBC on Wednesday that the S&P 500 could jump 26% through 2026 to 6,500. "I think this is a long-term bull market. I got still 5,400 by year-end and that was a pretty bold call a year ago, but right now that's looking pretty conservative, and why not more" Yardeni said.In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.

How much to invest to make $1 million in 15 years : But in order to be a millionaire via investing in 15 years, you'd only have to invest $43,000 per year (assuming a 6% real rate of return, which accounts for inflation). I know, I know – only $43,000 per year. No big deal. *From this point forward, the average real rate of return we'll be assuming is 6%.