To invest in stocks, open an online brokerage account, add money to the account, and purchase stocks or stock-based funds from there. You can also invest in stocks through a robo-advisor or a financial advisor.There is no citizenship requirement for owning U.S. stock and foreigners can easily access U.S. stock through U.S.-based brokers and international brokers. Despite its popularity among foreign investors, many foreigners haven't properly planned for the U.S. estate tax consequences of owning U.S. stock.

- 10 Step Guide to Investing in Stocks.

- Step 1: Set Clear Investment Goals.

- Step 2: Determine How Much You Can Afford To Invest.

- Step 3: Determine Your Tolerance for Risk.

- Step 4: Determine Your Investing Style.

- Choose an Investment Account.

- Step 6: Learn the Costs of Investing.

- Step 7: Pick Your Broker.

Can I invest in US stocks : Yes, Indians can invest in the US stock market. There is more than one way to buy and hold US stocks in your portfolio. Direct equities, ETFs, and mutual funds are just one of the few popular options. You can invest in US stocks in two ways from India – indirect and direct.

Can I buy US stocks without a broker

The short answer is no—you don't need a living, advice-giving, fee-charging broker (although you shouldn't rule them out). You do, however, need a brokerage—the online storefront where you purchase stocks, bonds, exchange-traded funds (ETFs), and other investments.

Are US stocks worth buying : Investing in US stocks is a sound idea for Indian investors to gain access to the largest and most liquid stock market globally. However, investors must thoroughly research the companies, understand the risks involved, and diversify their investments to ensure maximum potential returns while mitigating them.

Without appropriate documentation, income from U.S. investments may be subject to the U.S. domestic tax rate which is generally a flat 30% U.S. non-resident withholding tax rate.

Shares can be purchased through a Direct Stock Purchase and Dividend Reinvestment Plan sponsored and administered by Computershare Trust Company, N.A. Details about the Computershare Investment Plan, including any fees associated with the Plan, can be viewed and printed from Computershare's website.

Is it worth buying US shares

Directly investing in US shares provides you with more control as to which companies you would like exposure to. If you already have ASX shares as part of your portfolio, then being able to precisely dictate which sectors and companies you gain exposure to through US shares is valuable for risk sizing.If you want to buy US shares the US government will charge you a tax on any income you earn from those shares as you are not a US resident or citizen. Chances are you'd prefer to pay less of this tax (known as withholding tax) on your shares, which is where a W-8BEN form comes in.Many companies allow you to buy or sell shares directly through a direct stock plan (DSP). You can also have the cash dividends you receive from the company automatically reinvested into more shares through a dividend reinvestment plan (DRIP).

Here are some of the downside risks of investing in US equities. The first major risk is the currency fluctuation risk. For instance in the last 1 year, the rupee has weakened from Rs74/$ to Rs83/$. Since you can only invest in the US markets in dollars, you have currency risk at both legs of conversion.

Which US stock is best : Top 10 US Stocks in India

- Apple Inc.

- Microsoft Corporation (MSFT):

- Amazon.com, Inc.

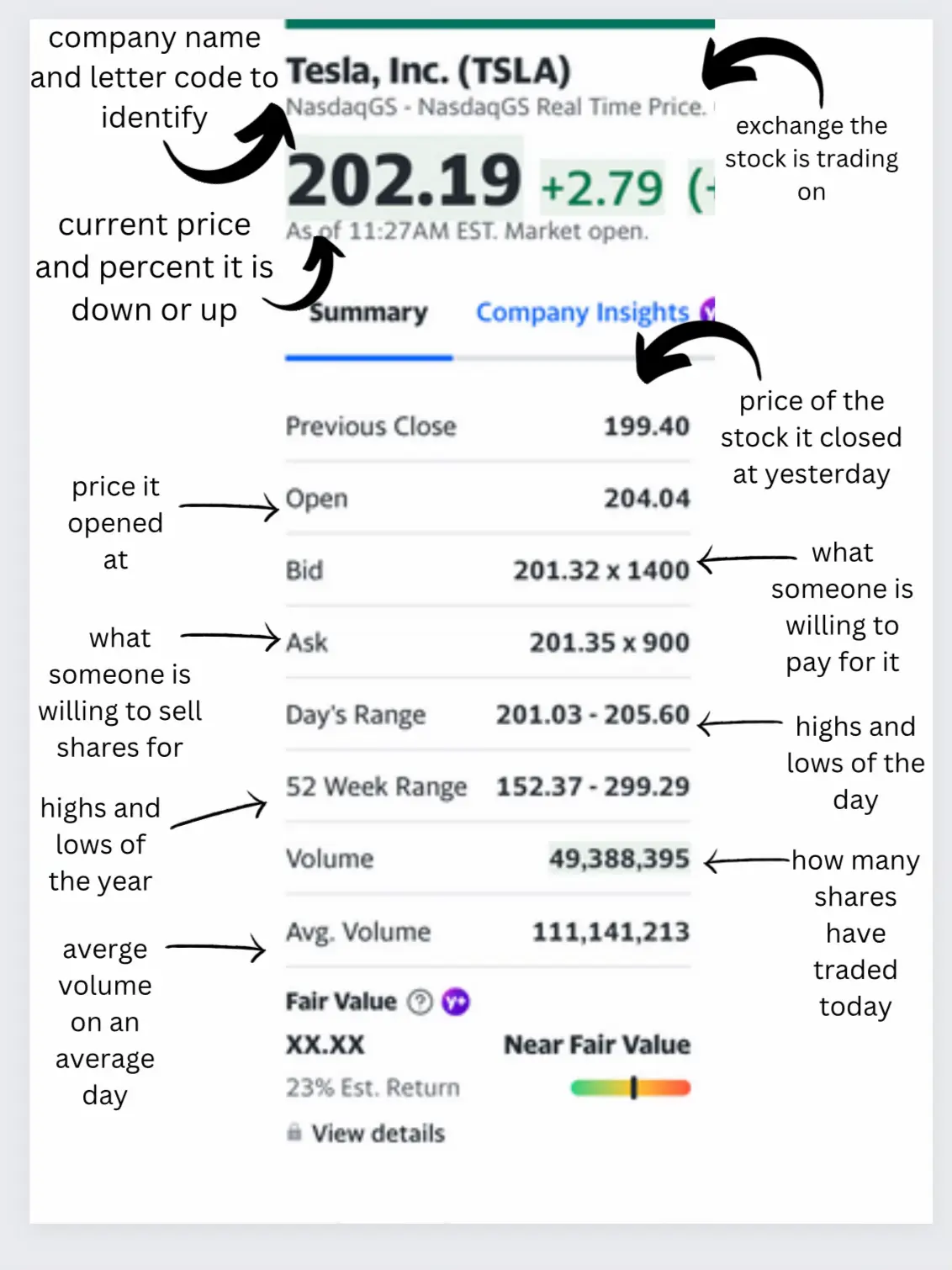

- Tesla, Inc.

- Johnson & Johnson (JNJ):

- Exxon Mobil Corporation (XOM):

- Walmart Inc.

Do foreigners pay taxes on US dividends : It is taxed for a nonresident at the same graduated rates as for a U.S. person. FDAP income is passive income such as interest, dividends, rents or royalties. FDAP income that is non-effectively connected income is taxed at a flat 30% rate on the gross income unless a tax treaty specifies a lower rate.

Do Americans pay tax on shares

How are stocks taxed There are two types of taxes on realized stock gains: short-term and long-term capital gains taxes. Tax rates on long-term capital gains are usually lower than those on short-term capital gains. That can mean paying lower taxes on stock sales.

You would have more than doubled your money, with a total investment worth of $2,029.55. That's a 103% return, or a 7.23% annual rate of return. Interestingly, despite Coke's dominance on the world stage, investing in Coke's main rival, Pepsi, 10 years ago would have given you more pop for your buck.Dividend Data

The Coca-Cola Company's ( KO ) dividend yield is 3.09%, which means that for every $100 invested in the company's stock, investors would receive $3.09 in dividends per year. The Coca-Cola Company's payout ratio is 73.72% which means that 73.72% of the company's earnings are paid out as dividends.

Do I have to pay tax on US shares : If you want to buy US shares the US government will charge you a tax on any income you earn from those shares as you are not a US resident or citizen. Chances are you'd prefer to pay less of this tax (known as withholding tax) on your shares, which is where a W-8BEN form comes in.