To stop payment, you need to notify your bank at least three business days before the transaction is scheduled to be made and your bank may charge a fee. The notice to stop the transaction may be made orally or in writing. A bank can require written confirmation of an oral stop payment request.Call and write your bank or credit union

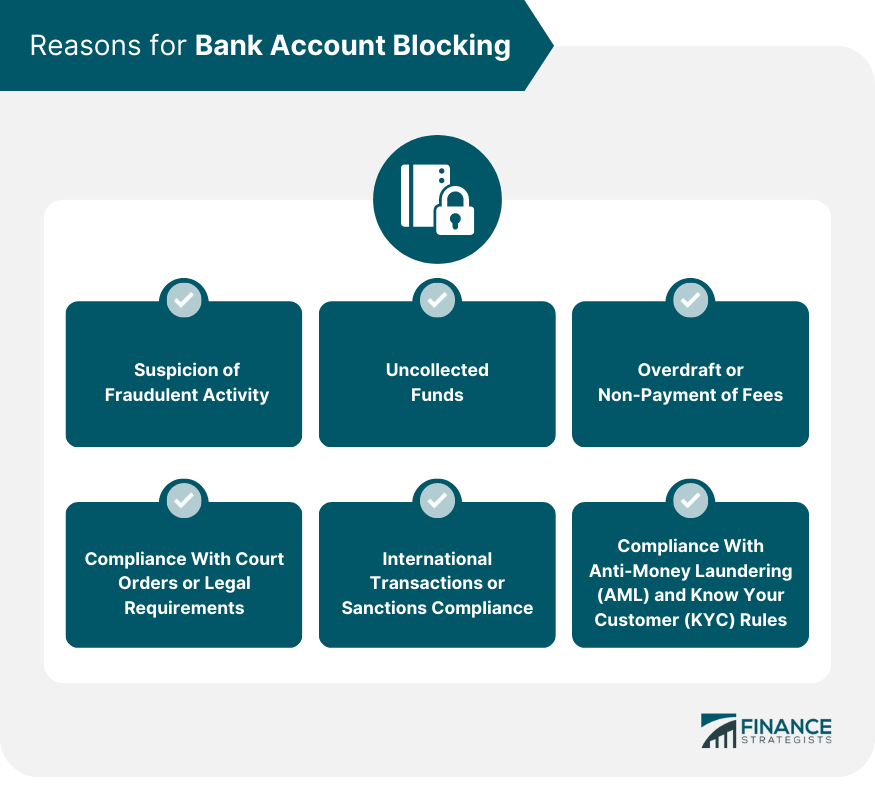

Tell your bank that you have “revoked authorization” for the company to take automatic payments from your account. You can use this sample letter . Some banks and credit unions may offer you an online form.Banks block transactions to safeguard their interests in the event of suspicious activity in your account or to comply with regulatory standards. You can work with your bank's anti-fraud team to tackle the problem, but if it persists, choose an alternative to traditional banking that protects 100% of your money.

Can I block a company from my bank account : Call the company and tell them you are taking away your permission for the company to take automatic payments out of your bank account. The company's customer service should be able to help you, and there might be an online form you can use. Then, follow up by writing a letter or an e-mail.

Is it possible to block a payment

You can tell the card issuer by phone, email or letter. Your card issuer has no right to insist that you ask the company taking the payment first. They have to stop the payments if you ask them to. If you ask to stop a payment, the card issuer should investigate each case on its own merit.

Can I stop a payment through my bank : You can contact your bank and place a stop payment order on the recurring transaction. Generally, a stop payment order is only good for six months. To stop payment, you will need to notify your bank at least three business days before the next payment is scheduled to be made. Notice may be made orally or in writing.

How do I stop a pending debit transaction You can stop a pending debit card transaction by contacting the merchant and canceling the purchase. Or you can try contacting your bank if you don't recognize the transaction, you suspect fraud is involved, or the merchant is unresponsive.

6 Ways to Protect Your Bank Account from Fraud

- Choose a strong and unique password.

- Use multi-factor authentication.

- Don't save your payment information online.

- Be aware of common scams.

- Check your accounts frequently.

- Report suspicious activity immediately.

Can a bank stop a transaction from going through

Your bank or credit card issuer can decline a pending transaction if it exceeds your available funds. How to cancel a pending transaction. Typically you can't cancel a pending transaction. Even if it's fraudulent or the wrong amount, your bank usually needs the transaction to post before it can next steps.To withdraw consent, simply tell whoever issued your card (the bank, building society or credit card company) that you don't want the payment to be made. You can tell the card issuer by phone, email or letter. Your card issuer has no right to insist that you ask the company taking the payment first.Yes, you can block a company from charging your credit card. You do this by contacting your bank and either revoking authorization for the payment or requesting a stop payment order.

You can't block someone from sending money to your account.

Can I call my bank to cancel a transaction : How do I stop a pending debit transaction You can stop a pending debit card transaction by contacting the merchant and canceling the purchase. Or you can try contacting your bank if you don't recognize the transaction, you suspect fraud is involved, or the merchant is unresponsive.

Can you cancel a bank transfer once sent : Can I reverse a bank transfer – or can my bank Online payments, like Faster Payments, transfer money in real-time. Once a payment has been made, you can't stop or reverse it. You have to go through the process of trying to get the money back from the recipient and rely on their cooperation.

Can I ask my bank to delete a transaction

It's important to note that while you can request corrections for errors, it is generally not possible to delete or remove legitimate transactions from your bank account history.

Once a transaction appears as pending on your account, you're unable to stop or cancel the transaction until it's complete. The merchant then sends us their transaction file for settlement, and we send the merchant your transaction payment.Account freezes prevent transactions from going through in a bank or brokerage account. Essentially, money can be deposited into the account but no money can leave the account. Account freezes can be put in place by an account holder (in the event of a lost or stolen debit card), or the bank or regulatory authority.

How do I stop money being taken from my bank account : You can contact your bank and place a stop payment order on the recurring transaction. Generally, a stop payment order is only good for six months. To stop payment, you will need to notify your bank at least three business days before the next payment is scheduled to be made. Notice may be made orally or in writing.

:max_bytes(150000):strip_icc()/3-reasons-banks-can-freeze-your-account.asp-Final-19076bd8fc794650af62d0e8c967d530.png)