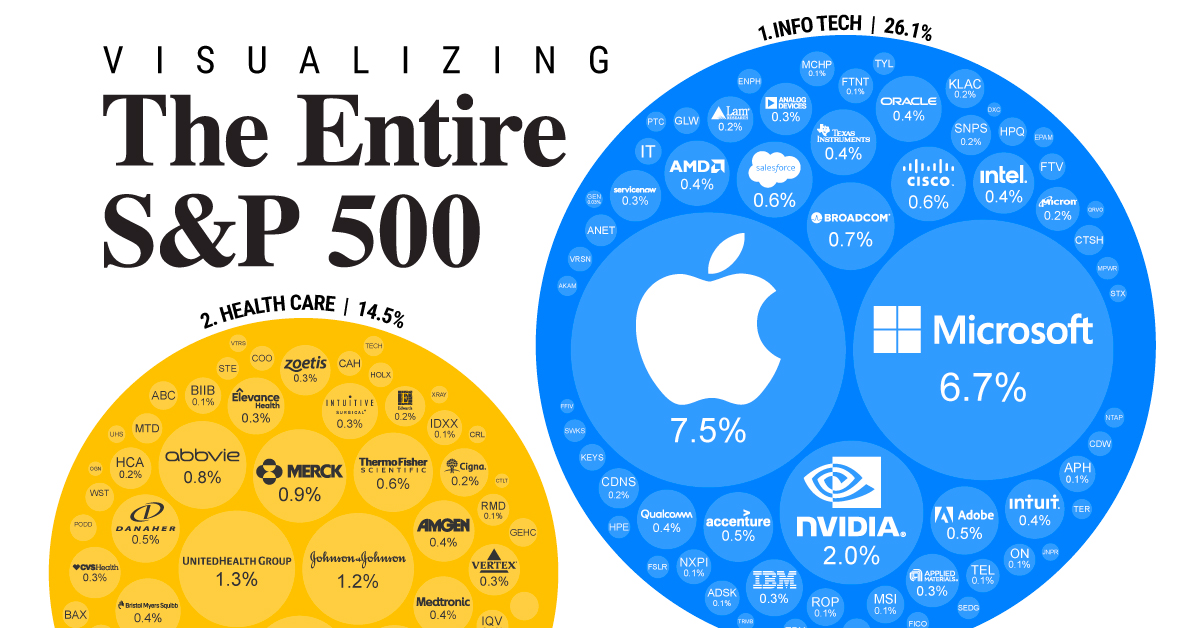

The S&P 500 Index, also known as the Standard & Poor's 500 or the US500, is an American stock market index that tracks the performance of the top 500 companies listed on the Nasdaq Stock Market or the New York Stock Exchange.Nasdaq US 500 Large Cap includes only the primary share class of the same company, while S&P 500 may list more than one share class. 4. Both indexes use the float-adjusted market capitalization weightings.If you search for S&P 500 ETFs, you may come across dozens of funds. Just because S&P 500 is in a fund's name doesn't necessarily mean it tracks the index as a whole. Rather, many of these ETFs track sub-components, say value or growth stocks, within the broader index.

Is SPX 500 and S&P 500 the same : SPX is a symbol referring to the S&P 500 index, which consists of the largest 500 publicly traded companies, as measured by market capitalization. Investors can't directly invest in SPX, but they can invest in ETFs or index funds that are designed to track the performance of the index.

Why is S&P 500 called S&P 500

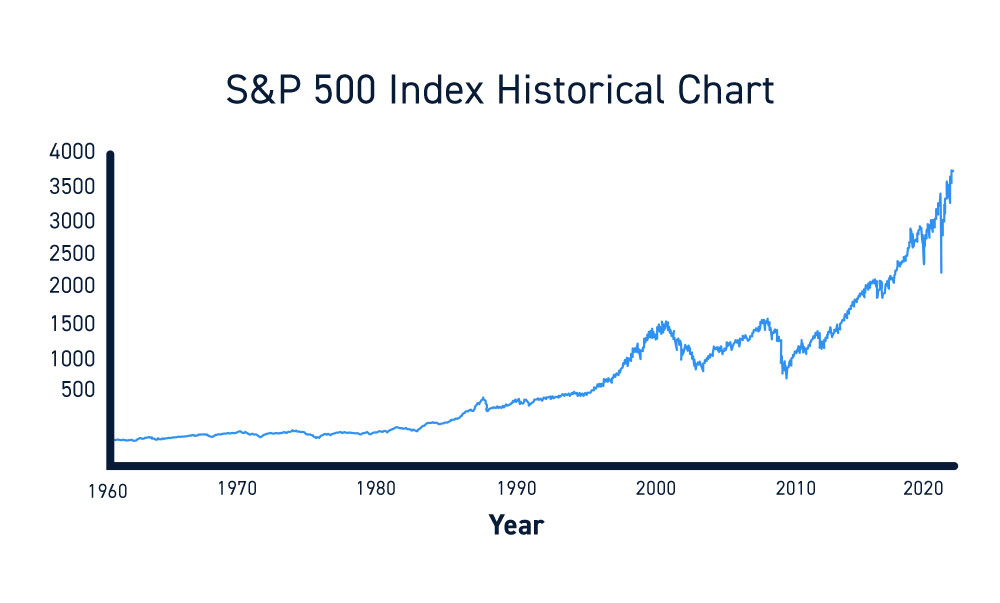

In 1941, Poor's Publishing merged with Standard Statistics Company to form Standard & Poor's. On Monday, March 4, 1957, the index was expanded to its current 500 companies and was renamed the S&P 500 Stock Composite Index.

Is S&P 400 better than S&P 500 : Mid-cap stocks tend to offer investors greater growth potential than large-cap stocks but with less volatility and risk than small-cap stocks. 2023 has been a year dominated by seven mega-cap names. The S&P 400 (a U.S. mid-cap index) is up only 5.6% YTD vs 19% for the S&P 500.

The S&P 500 index is composed of 505 stocks issued by 500 different companies. There's a difference in numbers because a few S&P 500 component companies issue more than one class of stock. For example, Alphabet Class C (GOOG 0.3%) and Alphabet Class A (GOOGL 0.43%) stock are both included in the S&P 500 index.

Top S&P 500 index funds in 2024

| Fund (ticker) | 5-year annual returns | Expense ratio |

|---|---|---|

| Vanguard S&P 500 ETF (VOO) | 14.5% | 0.03% |

| SPDR S&P 500 ETF Trust (SPY) | 14.5% | 0.095% |

| iShares Core S&P 500 ETF (IVV) | 14.5% | 0.03% |

| Schwab S&P 500 Index (SWPPX) | 14.5% | 0.02% |

Which S and P 500 is the best

You can use an S&P 500 index fund for a high-conviction, long-term bet on U.S. large-cap stocks. Our recommendation for the best overall S&P 500 index fund is the Fidelity 500 Index Fund. With a 0.015% expense ratio, it's the cheapest on our list.Vanguard S&P offers a lower expense ratio (0.035%) than SPY (0.095%), which means lower costs for investors and potentially higher net returns over the long term. VOO might be the more economical choice for cost-conscious investors, especially those investing large sums or planning for long-term goals like retirement.SPY options usually feature a tighter speed between their bid and offer than SPX options making them more price efficient for traders and investors. Because of its tighter markets, SPY options tend to have better price fills than SPX.

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Which S&P 500 to buy : Top S&P 500 index funds in 2024

| Fund (ticker) | 5-year annual returns | Expense ratio |

|---|---|---|

| iShares Core S&P 500 ETF (IVV) | 14.5% | 0.03% |

| Schwab S&P 500 Index (SWPPX) | 14.5% | 0.02% |

| Vanguard 500 Index Fund (VFIAX) | 14.5% | 0.04% |

| Fidelity 500 index fund (FXAIX) | 14.5% | 0.015% |

Which S&P 500 is best : Top S&P 500 index funds in 2024

| Fund (ticker) | 5-year annual returns | Expense ratio |

|---|---|---|

| iShares Core S&P 500 ETF (IVV) | 14.5% | 0.03% |

| Schwab S&P 500 Index (SWPPX) | 14.5% | 0.02% |

| Vanguard 500 Index Fund (VFIAX) | 14.5% | 0.04% |

| Fidelity 500 index fund (FXAIX) | 14.5% | 0.015% |

Is the S and P 500 still a good investment

But if researching and staying up to date on individual companies and their stocks isn't for you, you can still earn great returns by investing in a simple, broad-based index fund like the Vanguard S&P 500 ETF (VOO 0.19%).

Choosing your investments

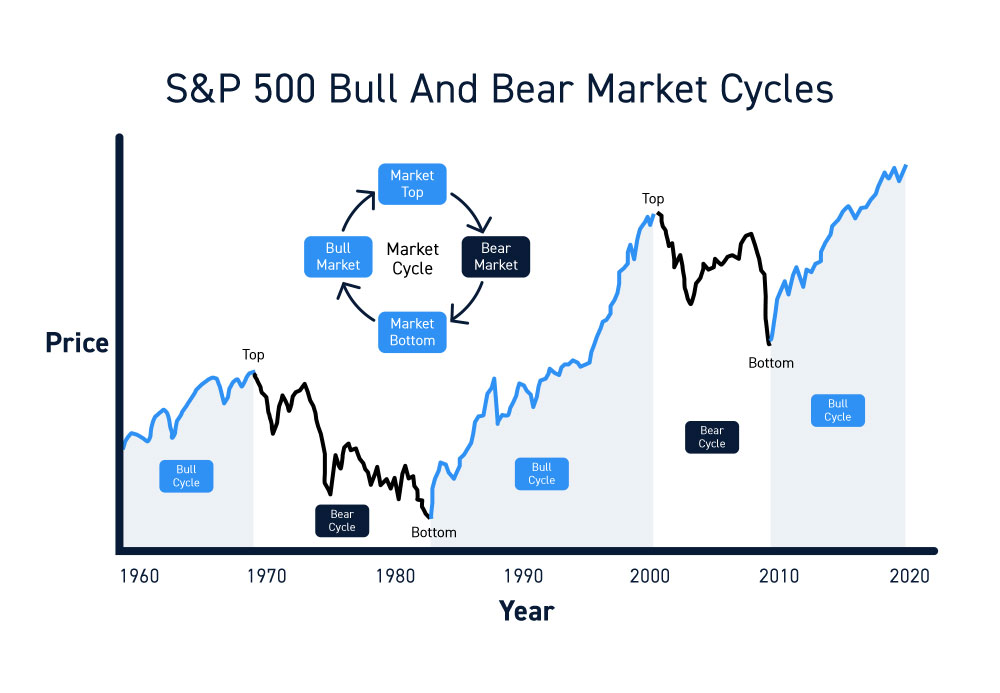

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

Why is SPY not equal to SPX : Key Distinctions between SPX and SPY

Ownership Architecture: SPX represents an ethereal index, while SPY is an earthly exchange-traded fund (ETF). The former is an abstract concept, an embodiment of market performance, while the latter is a tangible security with physical shares.

:max_bytes(150000):strip_icc()/SP-500-Index-d04148d29bca4307b412f4fd91741e17.jpg)