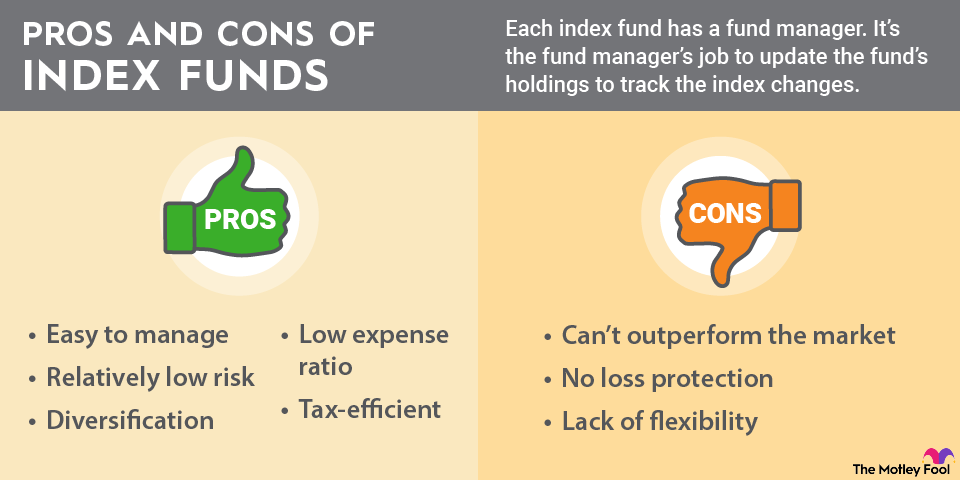

While they offer advantages like lower risk through diversification and long-term solid returns, index funds are also subject to market swings and lack the flexibility of active management.One share of an index fund based on the S&P 500 provides ownership in hundreds of companies, while a share of Nasdaq-100 fund offers exposure to about 100 companies. Lower risk: Because they're diversified, investing in an index fund is lower risk than owning a few individual stocks.Experts agree that for most personal investors, a portfolio comprising 5 to 10 ETFs is perfect in terms of diversification.

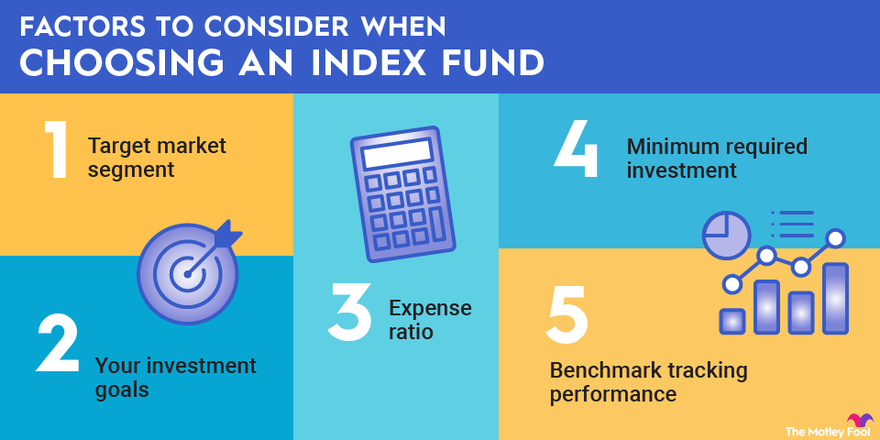

How much money to invest in index funds : How much is needed to invest in an index fund The minimum needed depends on the fund and your broker's policies. If your broker allows you to buy fractional shares of stock, you may be able to invest in index fund ETFs with as little as $1. If not, your minimum investment will be the cost of one share of the ETF.

Can index funds go broke

Much of it, yes, but not entirely. In a broad-based sell-off of a market, the benchmark index will lose value accordingly. That means an index fund tied to the benchmark will also lose value.

Is the S&P 500 safe : The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.

If you're new to investing, you can absolutely start off by buying index funds alone as you learn more about how to choose the right stocks. But as your knowledge grows, you may want to branch out and add different companies to your portfolio that you feel align well with your personal risk tolerance and goals.

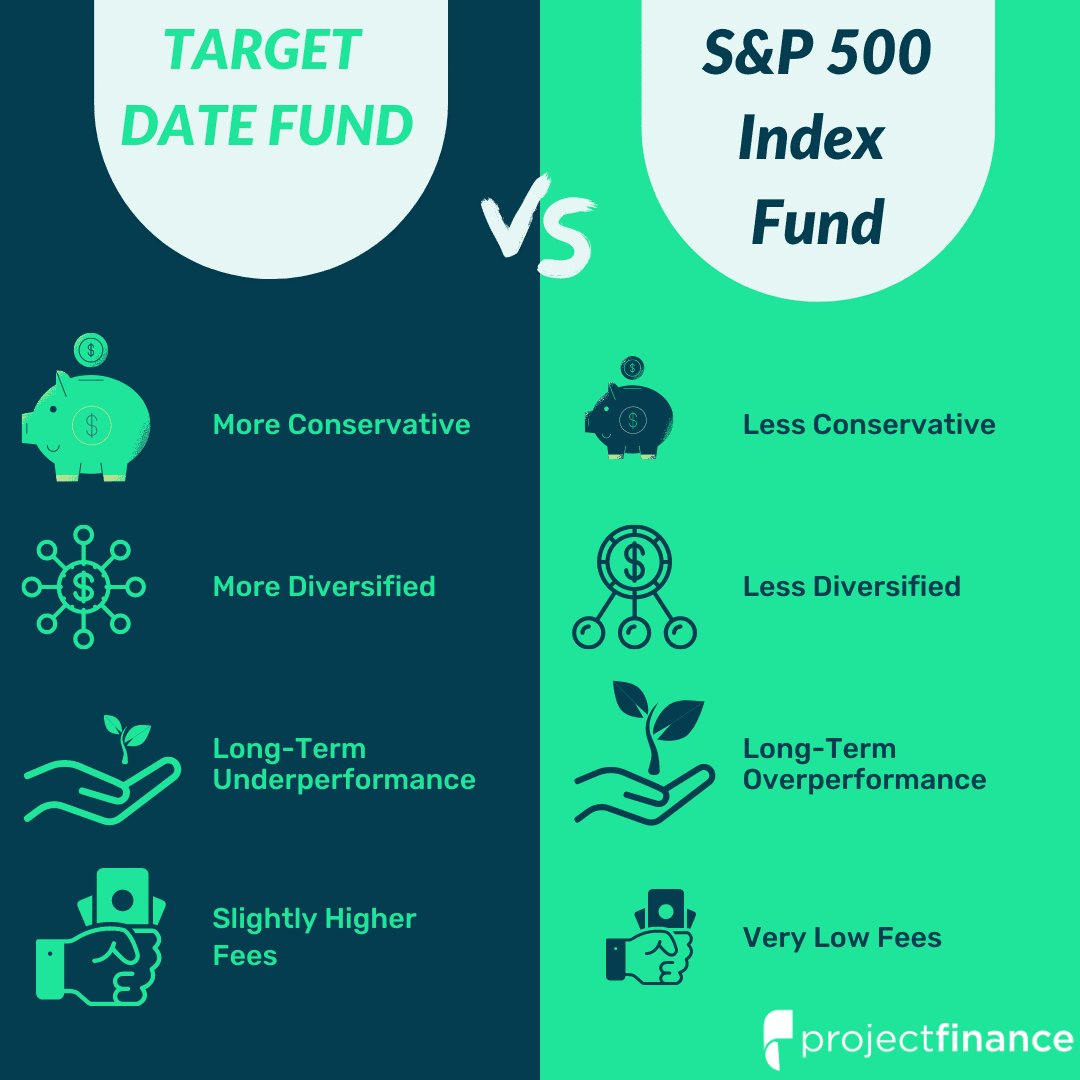

It might actually lead to unwanted losses. Investors that only invest in the S&P 500 leave themselves exposed to numerous pitfalls: Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses.

What is the 4% rule for index funds

The 4% rule says people should withdraw 4% of their retirement funds in the first year after retiring and take that dollar amount, adjusted for inflation, every year after. The rule seeks to establish a steady and safe income stream that will meet a retiree's current and future financial needs.Investing legend Warren Buffett has said that the average investor need only invest in a broad stock market index to be properly diversified. However, you can easily customize your fund mix if you want additional exposure to specific markets in your portfolio.Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

It's extremely unlikely you'll earn 10% returns every single year, but the annual highs and lows have historically averaged out to roughly 10% per year over several decades. Over a lifetime, it's possible to earn over half a million dollars with just $100 per month.

Can index funds go to zero : How Likely Are Index Funds to Go to Zero Index funds are generally not as volatile as individual stocks because of their diversification. But of course, if the underlying index is volatile, then the index fund will be, too, assuming it tracks the index's performance well.

Why not just invest in S&P 500 : The S&P 500 is all US-domiciled companies that over the last ~40 years have accounted for ~50% of all global stocks. By just owning the S&P 500 you miss out on almost half of the global opportunity set which is another ~10,000 public companies.

Do billionaires invest in index funds

It's easy to see why S&P 500 index funds are so popular with the billionaire investor class. The S&P 500 has a long history of delivering strong returns, averaging 9% annually over 150 years. In other words, it's hard to find an investment with a better track record than the U.S. stock market.

While there are few certainties in the financial world, there's virtually no chance that an index fund will ever lose all of its value. One reason for this is that most index funds are highly diversified. They buy and hold identical weights of each stock in an index, such as the S&P 500.Choosing your investments

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky.

Does Warren Buffett own S and P 500 : He holds nearly 40,000 shares of the SPDR S&P 500 ETF Trust (NYSE:SPY), valued at approximately $18.73 million. He has also maintained a stake in the Vanguard S&P 500 ETF (NYSE:VOO), holding 43,000 shares valued at $18.78 million.

:max_bytes(150000):strip_icc()/Term-Definitions_Index-665572b2712d4a6ca49b3f49179e3733.jpg)