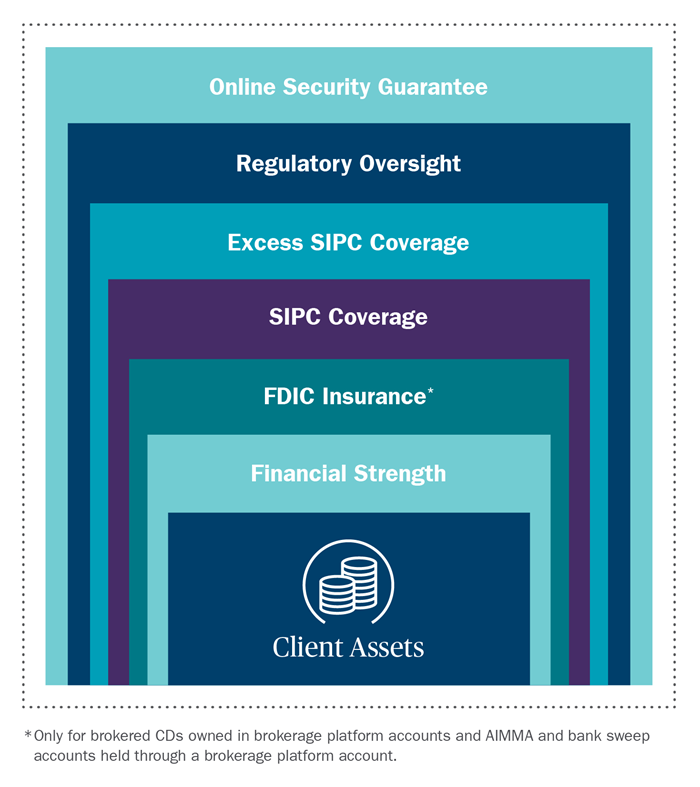

Cash and securities in a brokerage account are insured by the Securities Investor Protection Corporation (SIPC). The insurance provided by SIPC covers only the custodial function of a brokerage: It replaces or refunds a customer's cash and assets if a brokerage firm goes bankrupt.They must also have a certain amount of liquidity on hand, thus allowing them to cover funds in these cases. What this means is that even if you have more than $500,000 in one brokerage account, chances are high that you won't lose any of your money even if the broker is forced into liquidation.The Securities Investor Protection Corporation (SIPC) is a nonprofit membership corporation that protects customers of SIPC-member broker-dealers if those firms were to fail financially. SIPC protects brokerage accounts of each customer up to $500,000, including up to $250,000 for cash.

Why should no one use brokerage accounts : If the value of your investments drops too far, you might struggle to repay the money you owe the brokerage. Should your account be sent to collections, it could damage your credit score. You can avoid this risk by opening a cash account, which doesn't involve borrowing money.

What happens to a brokerage account if the bank fails

If you have a brokerage account through your bank, that money will be covered by the Securities Investor Protection Corporation (SIPC). The SIPC covers up to $500,000 of the securities and cash held in your brokerage account.

What happens if my brokerage firm fails : Typically, when a brokerage firm fails, the Securities Investor Protection Corporation (SIPC) arranges the transfer of the failed brokerage's accounts to a different securities brokerage firm. If the SIPC is unable to arrange the accounts' transfer, the failed firm is liquidated.

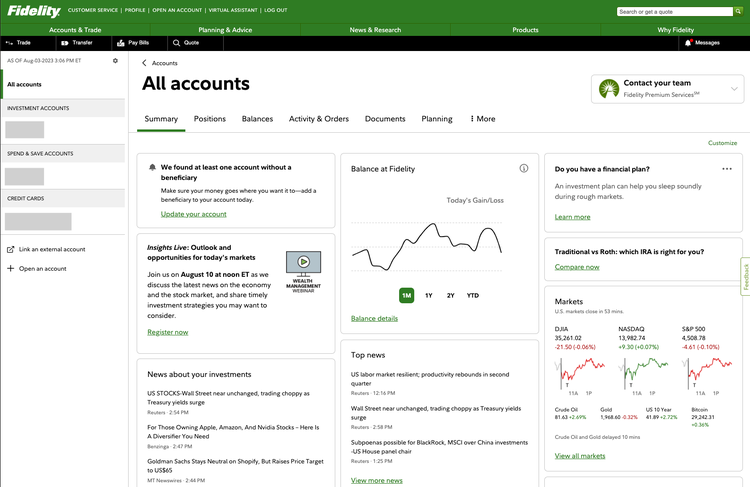

Best Brokers for High Net Worth Individuals

- Charles Schwab – Best for high net worth investors.

- Merrill Edge – Best rewards program.

- Fidelity – Best overall online broker.

- Interactive Brokers – Great overall, best for professionals.

- E*TRADE – Best web-based platform.

$500,000

SIPC Insurance limits

Generally, SIPC covers up to $500,000 per account per brokerage firm, up to $250,000 of which can be in cash.

Are my investments safe if bank fails

For the most part, if you keep your money at an institution that's FDIC-insured, your money is safe — at least up to $250,000 in accounts at the failing institution. You're guaranteed that $250,000, and if the bank is acquired, even amounts over the limit may be smoothly transferred to the new bank.Brokerage accounts don't offer all the services that a traditional bank offers. Brokerages might not offer additional products such as mortgages and other loans. Brokerages may not have weekend or evening hours.Under the right circumstances, brokerage accounts (or taxable investment accounts) can give your nest egg a bigger boost beyond your tax-advantaged retirement accounts. We always recommend investing in your 401(k) and IRA first because they offer tax benefits that you can't find anywhere else.

FDIC insurance protects your assets in a bank account (checking or savings) at an insured bank. SIPC insurance, on the other hand, protects your assets in a brokerage account. These types of insurance operate very differently—but their purpose is the same: keeping your money safe.

Can a brokerage account fail : Overview. Typically, when a brokerage firm fails, the Securities Investor Protection Corporation (SIPC) arranges the transfer of the failed brokerage's accounts to a different securities brokerage firm.

Can a brokerage account lose money : Many people fear putting money into a brokerage account for fear of losing it. And while it's true that a market downturn could cause your investments to lose value, you are protected against certain types of losses.

Has anyone become a millionaire from trading

While some traders have been successful in becoming millionaires through scalping trading, many others have lost money and blown up their trading accounts. It is important to note that trading carries significant risks, and traders should only trade with money they can afford to lose.

In conclusion, while it is possible to become a millionaire through forex trading, it is not a guaranteed path to wealth. Achieving such financial success requires a combination of education, skills, strategies, dedication, and effective risk management.While bank balances are insured by the Federal Deposit Insurance Corporation (FDIC), investments held in a brokerage account are covered by the Securities Investor Protection Corporation (SIPC). It protects investors in the unlikely event that their brokerage firm fails.

Is my money safe with Vanguard : Rest easy knowing the cash in your Vanguard Cash Plus bank sweep is eligible for FDIC coverage up to $1.25 million for individual accounts and $2.5 million for joint accounts. You can keep all your money in the bank sweep or diversify into 5 available Vanguard money market funds (each with a $3,000 minimum investment).

.png)