If you search for S&P 500 ETFs, you may come across dozens of funds. Just because S&P 500 is in a fund's name doesn't necessarily mean it tracks the index as a whole. Rather, many of these ETFs track sub-components, say value or growth stocks, within the broader index.The S&P 500 index, or Standard & Poor's 500, is a very important index that tracks the performance of the stocks of 500 large-cap companies in the U.S. The ticker symbol for the S&P 500 index is ^GSPC. The series of letters represents the performance of the 500 stocks listed on the S&P.The easiest way to invest in the S&P 500

The simplest way to invest in the index is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.

Is the S&P 500 safe : The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.

Which S and P 500 is the best

You can use an S&P 500 index fund for a high-conviction, long-term bet on U.S. large-cap stocks. Our recommendation for the best overall S&P 500 index fund is the Fidelity 500 Index Fund. With a 0.015% expense ratio, it's the cheapest on our list.

What is the difference between different S&P 500 index funds : While most S&P index funds will have similar holdings, they may vary in terms of their fees, such as expense ratios. Expense ratios are annual fees you pay to help cover a fund's expenses. If you invest in a fund with a 0.25% expense ratio, you'll pay $2.50 annually for every $1,000 invested.

Assuming an average annual return rate of about 10% (a typical historical average), a $10,000 investment in the S&P 500 could potentially grow to approximately $25,937 over 10 years.

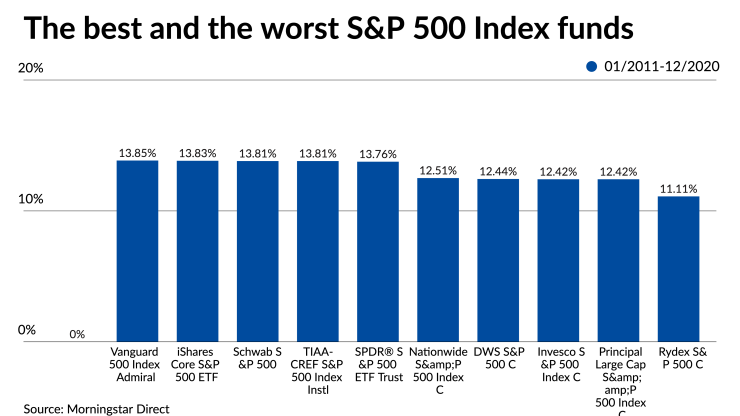

Top S&P 500 index funds in 2024

| Fund (ticker) | 5-year annual returns | Expense ratio |

|---|---|---|

| Vanguard S&P 500 ETF (VOO) | 14.5% | 0.03% |

| SPDR S&P 500 ETF Trust (SPY) | 14.5% | 0.095% |

| iShares Core S&P 500 ETF (IVV) | 14.5% | 0.03% |

| Schwab S&P 500 Index (SWPPX) | 14.5% | 0.02% |

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.The one time it's okay to choose a single investment

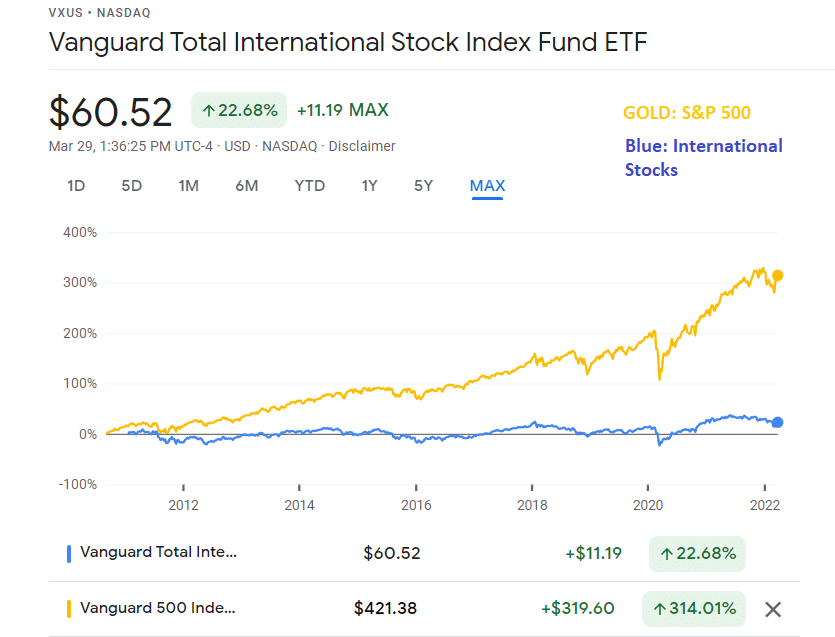

That's because your investment gives you access to the broad stock market. Meanwhile, if you only invest in S&P 500 ETFs, you won't beat the broad market. Rather, you can expect your portfolio's performance to be in line with that of the broad market.If you are a cost-conscious investor, the VOO, IVV, and SPLG might make a more attractive option compared to SPY with their lower expense ratios. Conversely, you might appreciate the higher liquidity of SPY if you're an active or institutional trader.

Investors, however, must consider the index fund that they select since not every one is low-cost, not some may be better at tracking an index than others. Moreover, owning an index does not mean you are immune from risk or losses if the markets take a downturn.

Can SP500 go to zero : Can an S&P 500 index fund investor lose all their money Anything is possible, of course, but it's highly unlikely. For an S&P 500 investor to lose all of their money, every stock in the 500 company index would have to crash to zero.

How much would $10,000 invested in the S&P 500 in 2000 be worth today : Think About This: $10,000 invested in the S&P 500 at the beginning of 2000 would have grown to $32,527 over 20 years — an average return of 6.07% per year.

Should I buy Spy or VOO

If you are a cost-conscious investor, the VOO, IVV, and SPLG might make a more attractive option compared to SPY with their lower expense ratios. Conversely, you might appreciate the higher liquidity of SPY if you're an active or institutional trader.

In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.The short answer to what happens if you invest $500 a month is that you'll almost certainly build wealth over time. In fact, if you keep investing that $500 every month for 40 years, you could become a millionaire. More than a millionaire, in fact.

Do billionaires invest in index funds : It's easy to see why S&P 500 index funds are so popular with the billionaire investor class. The S&P 500 has a long history of delivering strong returns, averaging 9% annually over 150 years. In other words, it's hard to find an investment with a better track record than the U.S. stock market.

:max_bytes(150000):strip_icc()/SP-500-Index-d04148d29bca4307b412f4fd91741e17.jpg)

:max_bytes(150000):strip_icc()/Investopedia-terms-indexfund-f7a1af966bd34da5b77ca1627607e41b.png)